ECON 2400N Test 2 Information

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 2400N Test 2 Information

Test 2 will be completed via our eClass course page. The test link can be found on the home page under the heading Tests and Exam. The test window will open on Wednesday, March 8th at 1:00pm and close at 2:30pm. Students have one, 1.5 hour (90 minute) attempt to complete the test. If a student begins the test after 1:00pm, they will still only be able to write until 2:30pm.

All test questions will be visible to students on a single page from the start of the test. If, during the test, a student has a technical issue or a question related to the test itself, they should email me about it at [email protected]. I will be near my inbox throughout the test window and respond ASAP to your email.

In terms of review questions, students are encouraged to work on the chapter questions (posted on our eClass page). These chapter questions are not necessarily reflective of the formats you will see in the test, but they are extremely useful study aids and will help you develop your comprehension of the course material to a level at which you can effectively answer any test question.

The test will include a mix of short answer, graphing, calculation, and fill in the blank questions.

Short answer questions: In these questions, students will be presented with some information and will be expected to provide a written answer to the given question.

Graphing questions: In these questions, students will be presented with some information and will be expected to draw and upload a diagram based on this information.

Calculation questions: In these questions, students will be presented with some information and will be expected to incorporate this information into formulas covered in the material.

Fill in the blank questions: In these questions, students will be presented with some information and will be expected to choose the most appropriate answers from the options available.

In order to help familiarize students with these formats, I've included examples below (answers follow). While these review questions are helpful in terms of getting more familiar with the question formats, they do not necessarily reflect the topics that will be covered in the test or the degree of difficulty of the test questions.

REVIEW QUESTIONS

Short Answer

Evaluate the accuracy of the following statement: “The theory of purchasing power parity is generally applicable to shares of a company’s stock traded on stock exchanges in different countries.”

Graphing

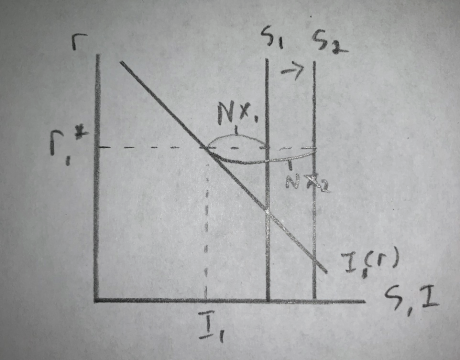

Consider a small open economy that initially has a trade surplus.

a) Draw a diagram illustrating this economy's loanable funds market. Be sure to label the axes, curves (with the subscript 1) and equilibrium values (with the subscript 1).

b) Assume that the domestic government has increased taxes. On the same diagram as part a, illustrate this change to the economy's loanable funds market. Be sure to label the curves and new equilibrium values (each with the subscript 2).

Calculation

Consider an economy with $2 million in currency. Calculate this economy’s money supply in each of the following three scenarios.

a) The economy has no banks.

b) The economy has banks that keep 100% of deposits in reserve and citizens opt to deposit all currency they hold.

c) The economy has banks that keep 25% of deposits in reserve and citizens opt to deposit all currency they hold.

Fill in the Blank

Consider a small open economy. Suppose that the government in this economy decides to decrease government spending. Given this information, we would expect the economy’s national saving to _______ (choose one of increase, decrease, or not change), investment to _______ (choose one of increase, decrease, or not change), net exports to _______ (choose one of increase, decrease, or not change), and real exchange rate to _______ (choose one of increase, decrease, or not change).

ANSWERS TO REVIEW QUESTIONS

Short Answer

Evaluate the accuracy of thefollowing statement: “The theory of purchasing power parity is generally applicable to shares of a company’s stock traded on stock exchanges in different countries. ”

This statement is accurate, as the typical reasons why PPP does not apply to most goods and services do not apply to shares of a company’s stock traded on stock exchanges in different countries.

International arbitrage is possible in this case, as one can purchase a share of TD Bank stock (for example) from the Toronto Stock Exchange and sell the share on the New York Stock Exchange. TD Bank shares traded on the two exchanges are perfect substitutes for one another. Moreover, the “transportation costs” are limited to the small fees charged by stock brokerage firms.

At close of trading on March 3rd, the market price of a share of TD Bank stock was $65.49 USD on the NYSE and $89.05 CAD on the TSX. Applying the 0.7355 USD/CAD exchange rate to the TSX price gives us a USD price of $65.49.

Graphing

Consider a small open economy that initially has a trade surplus.

a) Draw a diagram illustrating this economy's loanablefunds market. Be sure to label the axes, curves (with the subscript 1) and equilibrium values (with the subscript 1).

b) Assume that the domestic government has increased taxes. On the same diagram as part a, illustrate this change to the economy's loanablefunds market. Be sure to label the curves and new equilibrium values (each with the subscript 2).

Calculation

Consider an economy with $2 million in currency. Calculate this economy’s money supply in each of thefollowing three scenarios.

a) The economy has no banks.

Money Supply = Currency + Deposits = $2 million + $0 = $2 million

b) The economy has banks that keep 100% of deposits in reserve and citizens opt to deposit all currency they hold.

Money Supply = Deposits x (1/Reserve Ratio) = $2 million x (1/1) = $2 million

c) The economy has banks that keep 25% of deposits in reserve and citizens opt to deposit all currency they hold.

Money Supply = Deposits x (1/Reserve Ratio) = $2 million x (1/0.25) = $8 million

Fill in the Blank

Consider a small open economy. Suppose that the government in this economy decides to decrease government spending. Given this information, we would expect the economy ’s national saving to _______ (choose one of increase, decrease, or not change), investment to _______ (choose one of increase, decrease, or not change), net exports to _______ (choose one of increase, decrease, or not change), and real exchange rate to _______ (choose one of increase, decrease, or not change).

Consider a small open economy. Suppose that the government in this economy decides to decrease government spending. Given this information, we would expect the economy’s national saving to increase, investment to not change, net exports to increase, and real exchange rate to decrease.

2023-03-10