FNCE90011 Practice/Review Questions

FNCE90011 Practice/Review Questions

Question 1

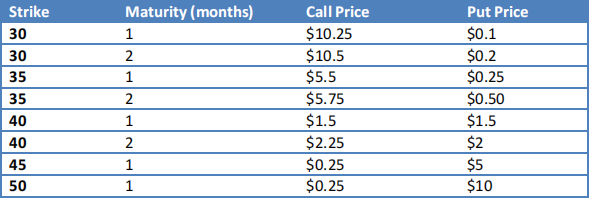

The current stock price of a firm equals $40. The following European options trade on this firm.

a) Using the at-the-money options, what is the simple risk free rate for a 1-month and a 2-month horizon if the stock does not pay any dividends?

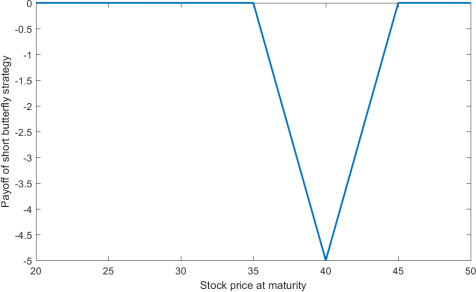

b) Draw the payoff diagram of a 1-month at-the-money short butterfly with the smallest range of strike prices.

c) The short butterfly pays off a non-positive amount at maturity. What is the requirement for the current price of the short butterfly so that there are no arbitrage opportunities?

d) If we are to take a position in the short butterfly, should we be using puts or calls?

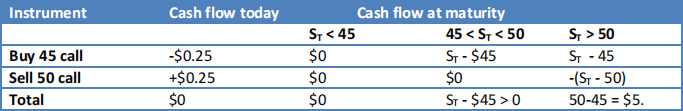

e) Is there an arbitrage opportunity in the prices of the call options with different strikes? If so, show the cash flow table that exploits it.

f) Suppose the continuously compounded interest rate is 3% annualized. How can you make an arbitrage profit by trading the 30-strike, 2-months-to-maturity options?

g) Suppose the continuously compounded interest rate is 3% annualized. Is the price for the 30-strike, 1-month call option within the arbitrage bounds for the call option?

h) You think the stock price is going to drop over the next 2 months from $40 to $34 and you are going to set up a bearish vertical spread to express that view. There are 4 possibilities to construct the spread using the options in the table above where one of the options in the spread has strike $40. List them all. What is the maximum profit in each case assuming that the stock price will indeed drop to $34, but not lower than that?

i) Would you change the strategy developed under h) if you think the stock price will drop to $32 rather than $40? 2

Question 2

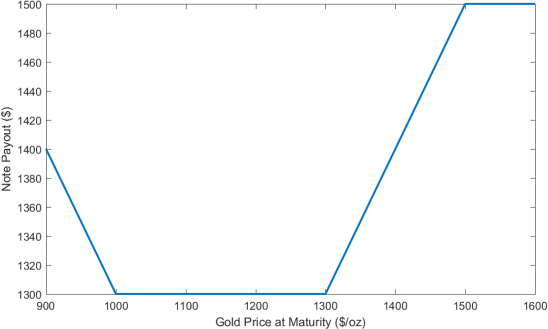

Gold mining company DigBig is issuing a gold-linked note with a maturity of 2 years. The current gold price is $1300/oz. The payout of the note is displayed in the figure below. The continuously compounded risk free rate equals 4% annualized. The note is constructed from a zero-coupon bond with a par value equal to the current gold price, and some plain vanilla European put and call options with strikes of 1000, 1300 and 1500. The note will be priced at par (= $1300) initially.

a) What are the securities needed to replicate the payout of the note?

b) What is the current price of the bond position?

c) If the Black-Scholes assumptions are true and the volatility of gold is 25% annualized, what is the price of the lowest strike option?

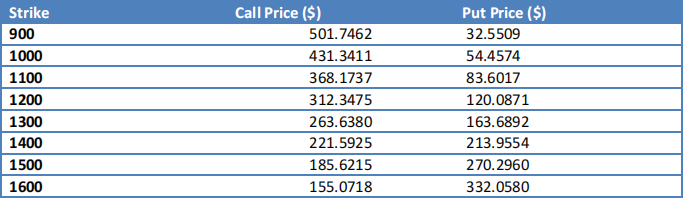

d) Suppose the prices of the options are given by the table below. Does DigBig offer the note at a fair price?

Question 3

A stock price is currently $50. It is known that at the end of six months it will be either $60 or $42. The risk-free rate of interest with continuous compounding is 12% per annum. Use a one-step binomial tree to calculate the value of a six-month European call option on the stock with an exercise price of $48. Verify that no-arbitrage arguments and risk-neutral valuation arguments give the same answers.

Question 4

Consider an option on a non-dividend-paying stock when the stock price is $30, the exercise price is $29, the continuously compounded risk-free interest rate is 5% per annum, the volatility is 25% per annum, and the time to maturity is four months. The assumptions of the Black-Scholes model hold.

a) What is the price of the option if it is a European call?

b) What is the price of the option if it is an American call?

c) What is the price of the option if it is a European put?

d) Verify that put–call parity holds.

e) What is the delta of a portfolio that is long 1 European call and short 2 European puts?

f) What is the delta of the stock?

Question 5

Gold futures contracts that mature 3 months hence have a futures price of $309 per oz.

Gold futures contracts that mature 6 months hence have a futures price of $324 per oz.

T-Bills that mature in three months are priced to yield a 3% return over the quarter—invest $1 and receive $1.03 after three months.

T-Bills that mature in 6 months are priced to yield a 7% return over the half-year—invest $1 and receive $1.07 after six months.

Storing costs for gold are equal to zero, and there are no other benefits derived from holding spot gold.

Explain clearly and completely how to lock in an arbitrage profit by taking positions in some combination of gold, T-Bills and gold futures. Calculate the arbitrage profit from your strategy. Ignore the daily marking-to-market of a futures contract.

Question 6

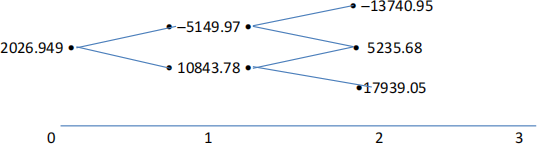

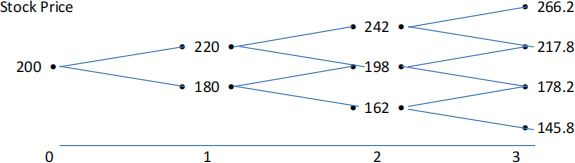

Consider the stock price process below, with time measured in months.

The risk-free rate with annual compounding is 12.682503% per year. Note that 1.12682503 = 1.0112 .

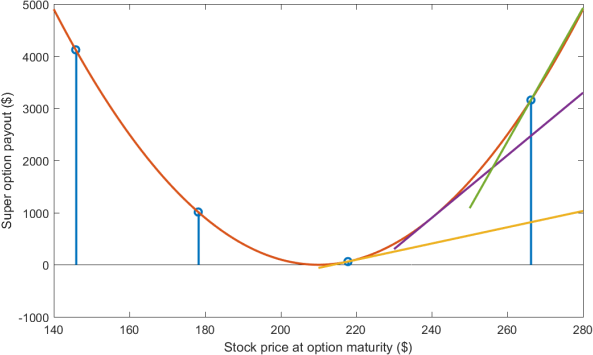

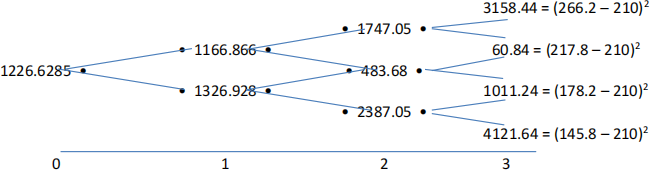

Let us invent a new option: The Super Option. The Super Option will mature in three months and will pay (ST − X)2 where ST is the stock price at the Super Option’s time T maturity. Let X = 210.

(a) For each stock price and time to maturity what position in stock and bonds would one take if one wished to replicate the Super’s payoff at maturity through a dynamic trading strategy?

(b) Draw a diagram of the payoff at maturity to the Super Option as a function of ST.

(c) Thinking of the payoff to the Super Option as analogous to the payoff from a rather complex portfolio of European puts and calls, explain why your answer to part (a) is intuitively correct.

(d) For each stock price and time to maturity what is the Super Option worth?

Solutions

See also the MATLAB file ‘ PracticeQuestions.m’

Question 1

a) Use put-call parity with a strike of $40. 1-month: $1.5 + $40/(1+R) = $1.5 + $40 → R = 0 2-months: $2.25 + $40/(1+R) = $2 + $40 → R = 0.0063.

b) A short butterfly consists of -1 option @35, +2 options @40 and -1 option @45, all of the same type.

c) The short butterfly will generate a nonpositive payout at maturity, so the current price also has to be nonpositive. That is, if we set up the butterfly, we should be receiving some money today.

d) We can construct the butterfly using either puts or calls. The price if we use calls equals: -1*$5.5+2*$1.5-1*$0.25 = -$2.75. The price if we use puts equals -1*$0.25+2*$1.5-1*$5 = -$2.25. Hence, we get more money today if we use the calls, so that is our preferred strategy.

e) Yes, the prices of the 1 month 45 and 50 calls are the same. The 45 call should be more expensive than the 50 call. Since it is not, we buy the 45 call and sell the 50 call.

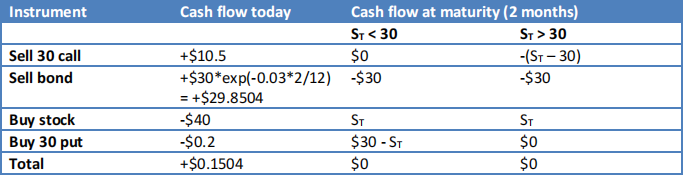

f) From put-call parity, we have c + BK = $10.5 + $30*exp(-0.03*2/12) = $40.35, but S + p = $40 + $0.2 = $40.20. Hence, we sell the call and the bond, and buy the stock and the put to obtain the following table.

g) The minimum price follows from c ≥ max(S-BK,0) = $40 - $30*exp(-0.03/12) = $10.0749 so this is satisfied. The maximum price follows from c ≤ S = $40 which is also satisfied. So the call price is within the arbitrage bounds.

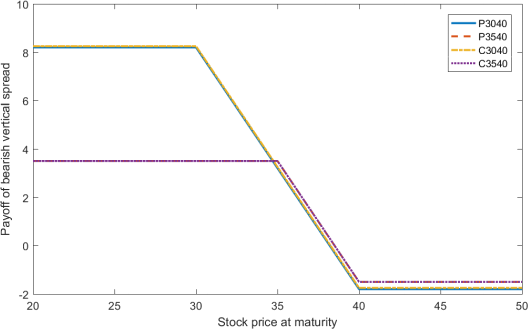

h) We can set up a bearish vertical spread to profit from this expected decrease. This can be set up by either:

a. Buying a put @40 and selling a put @35 or @30, or

b. By buying a call @40 and selling a call @35 or @30.

If the option prices would be arbitrage free, it should not matter whether we use puts or calls to set up the strategy. Since we have identified various arbitrage opportunities already however, we have to be careful and examine all strategies.

Strategy a. (40 and 35-strike) costs $2-$0.5 = $1.50 today for a maximum profit of $5-$1.50 = $3.50. Strategy a. (40 and 30-strike) costs $2-$0.2 = $1.80 today for a maximum profit of $6-$1.80 = $4.20 if the stock price indeed decreases to $34. Note that the profit can be higher if the stock price decreases further, but that is not the part we should be considering when comparing the different strategies since we are only interested in future stock prices between $34 and $40.

Strategy b. (40 and 35-strike) costs $2.25-$5.75 = -$3.50 today. This is also the maximum profit, obtained for ST < 35. Strategy b. (40 and 30-strike) costs $2.25-$10.50 = -$8.25 today. For a stock price of $34, the profit will be $8.25-($34-$30) = $4.25.

Comparing the four strategies, the highest profit can be obtained by using the 30 and 40-strike call options to set up the bear spread. The figure below displays the profits of the different strategies as a function of the stock price.

i) If we think the stock price can decrease to $32 rather than $34, we would definitely settle for the 30-40 strike combination when setting up the bearish spread. Again, the call spread will deliver the highest profit potential because of the arbitrage opportunities in the prices, so we stick to our 30-40 call bear spread.

Question 2

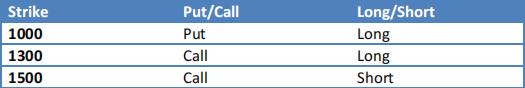

a) In addition to the bond position, we need 3 options. The following table summarizes.

b) $1300*exp(-0.04*2) = $1200.0513.

c) The lowest strike option is a put with strike 1000. The price follows as BSPut(1300,1000,0.04,2,0.25) = $33.9264 If you use a table to calculate the normal distribution value, you should be using the following values: d1 = 1.15 (1.1451 unrounded), d2 = 0.79 (0.7916 unrounded), N(-d1) = 0.1251, N(-d2) = 0.2148, for a put price of about $35.66.

d) The price of the replicating portfolio using the option prices in the table equals $1200.0513 + $54.4574 + $263.6380 - $185.6215 = $1332.53. Since the note is offered at $1300, DigBig does not make the most of the note. It could be sold for $32.53 more to make it fairly priced and raise additional cash for DigBig.

Question 3

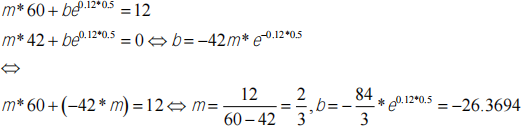

No-arbitrage approach 1:

We replicate the call option payoff by investing in m shares and a position b in bonds.

The value of the portfolio will be m*60 + b in the up state, and m*42 + b in the down state. In order to replicate the option payoff, we need to solve

Hence, buying 2/3 shares and borrowing 26.37 dollars will replicate the call option payoff. In order to preclude arbitrage, the current price of the call option should be the same as that of the portfolio. The current price of that portfolio equals 50*2/3 – 26.37 = $6.96.

No-arbitrage approach 2: At the end of six months the value of the option will be either $12 (if the stock price is $60) or $0 (if the stock price is $42). Consider a portfolio consisting of:

+Δ : shares

−1 : option

The value of the portfolio is either 42Δ or 60Δ − 12 in six months. If

42Δ = 60Δ − 12

i.e.,

Δ = 0.6667

the value of the portfolio is certain to be 28. For this value of Δ the portfolio is therefore riskless. The current value of the portfolio is:

0.6667 x 50 − f

where f is the value of the option. Since the portfolio must earn the risk-free rate of interest

(0.6667 x 50 − f) e0.12x0.5 = 28

i.e.,

f = 6.96

The value of the option is therefore $6.96.

This can also be calculated using risk-neutral valuation. Suppose that p is the probability of an upward stock price movement in a risk-neutral world. We must have

60 p + 42(1 − p) = 50 x e0.06

i.e.,

18 p = 11.09

or:

p = 0.6161

The expected value of the option in a risk-neutral world is:

12 x 0.6161 = 0 x 0.3839 = 7.3932

This has a present value of

7.3932e-0.06 = 6.96

Hence the above answer is consistent with risk-neutral valuation.

Question 4

(If you use a table to calculate values of the normal distribution, your prices, deltas and thetas can be different due to rounding errors).

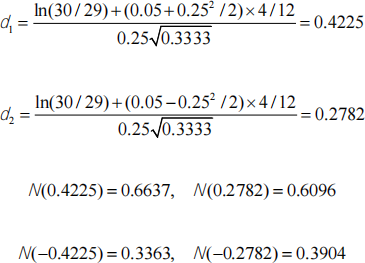

In this case S0 = 30, K = 29, r = 0.05, σ = 0.25 and T = 4/12

a) The European call price is

30 x 0.6637 − 29e-0.05x4/12 = 0.6096 = 2.52

b) Because the stock does not pay dividends, the American call price is the same as the European call price. It is $2.52.

c) The European put price is

29e-0.05x4/12 x 0.3904 − 30 x 0.3363 = 1.05

d) Put-call parity states that:

p + S = c + Ke-rT

In this case c = 2.52, S0 = 30, K = 29 , p = 1.05 and e-rT = 0.9835 and it is easy to verify that the relation is satisfied.

e) The delta of the call equals N(d1) = 0.6637. The delta of the put equals –N(-d1) = -(1-N(d1)) = -0.3363. Hence, the delta of a portfolio that is long 1 call and short 2 puts has a delta of 0.6637 – 2*(-0.3363) = 1.3363.

f) Delta measures the change in the value of a security for a given change in the value of the underlying stock. Therefore, the delta of the stock is always equal to 1.

Question 5

The 3-month futures price implies that spot gold should be trading at $309/1.03 = $300.

The 6-month futures price implies that spot gold should be trading at $324/1.07 = $302.80.

Thus the 6-month contract is overpriced relative to the 3-month contract.

Today: Go long the 3-month contract.

Go short the 6-month contract.

Lend $300 for 3 months.

Borrow $302.80 for 6 months.

Net $2.80 = arbitrage profit.

At the end of 3 months:

Take delivery of gold.

Pay $309 with proceeds of maturing T-Bills.

Store gold for one quarter.

At the end of 6 months:

Deliver the stored gold to close out your short futures position.

Use the $324 futures price received upon delivery to repay your borrowing.

Question 6

(a)

Δ: Quantity of Shares

B: Position in Bonds

(b)

The super’s payoff is equivalent to that from a portfolio of calls and puts. There is an increasing number of calls with higher and higher exercise prices above 210. There is an increasing number of puts with lower and lower exercise prices below 210.

When the value of the underlying exceeds the option’s strike price, the replicating strategy is like that for calls; i.e., long stock and borrowing. When the value of the underlying asset is below the option’s strike price, the replicating strategy is like that for puts; i.e., short stock and lending.

(c) Super Option Price

2021-06-10