ECOM 058 – Principles of Accounting 2020/21 Lecture 4

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECOM 058 – Principles of Accounting 2020/21

Lecture 4 – Problem set

What do we mean by carrying amount of a non-current asset?

What is an impairment of PPE? Which effects does it have on cash flows?

What are the three key attributes of intangible assets?

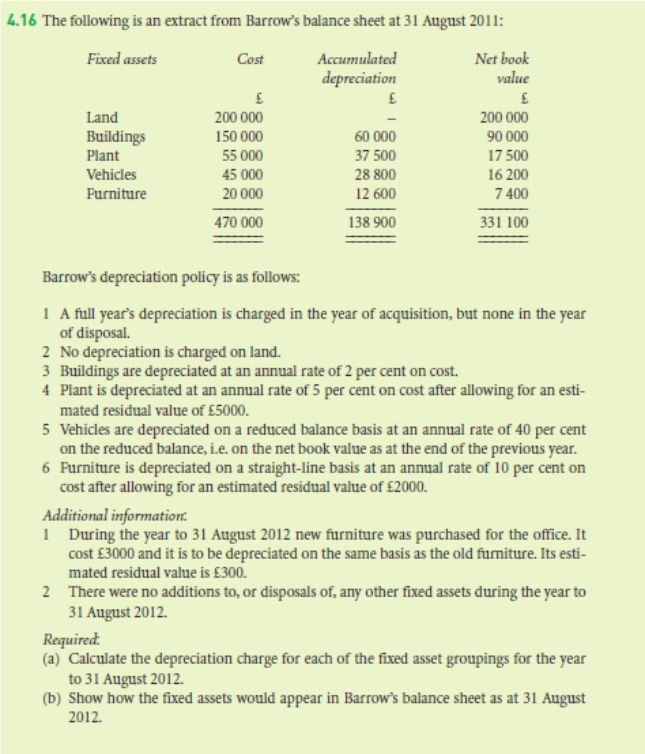

![]() Exercise 1

Exercise 1

Company Keegan Plc bought a new van for 40.000£ at the beginning of 2012. It assumes a useful life of 4 years and a residual value of 1.024£.

a) Calculate the yearly depreciation charges over the life of the asset assuming straight line depreciation

b) Calculate the yearly depreciation charges over the life of the asset assuming reducing balance depreciation with a rate of 60%.

c) Comment on the implications for profits between 2012 and 2016 of the two different methods

![]() Exercise 2

Exercise 2

Consider the following unadjusted trial balance prepared at the end of the year by a company (suppose no inventory for simplicity: cost of goods sold is equal to purchases):

UNADJUSTED TRIAL BALANCE

debit credit

capital 100

cash 30

PPE at cost 60

accumulated depreciation 10

(beginning of year)

wage expenses 50

purchases 100

sales 250

rent expenses 80

electricity expenses 40

TOT 360 360

Additional information:

a) Rent expenses include 30 paid in advance for rent in the next year

b) The company estimates that it has consumed 20 of electricity that has not been paid

c) Depreciation of PPE for the year is 10

Prepare the adjusted trial balance considering the information above. Afterwards, use the adjusted trial balance to prepare the income statement and the balance sheet

![]() Exercise 3

Exercise 3

Consider the adjusted trail balance and the financial statements obtained in exercise 2.

Now suppose there is one additional transaction in the year: the company sold its whole PPE for 100 receiving an immediate cash payment . This happened close to year end, so depreciation is still charged in full for the year.

Show how this transaction would impact the adjusted trial balance and the financial statements.

![]() Exercise 4

Exercise 4

2023-03-07