ECON 2112. PROBLEM SET 3

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ECON 2112. PROBLEM SET 3

DUE: 11 MARCH, SATURDAY NOON

Exercise 1. [3 points] Airbus and Boeing - A and B hereafter - are two major players in the market for aircrafts. B is deciding whether to enter a new market. If B stays Out, B receives 0 and A bags $100 million in proit. If B enters, i.e., if B stays In, A can either start a Price war or Accommodate. If A chooses Accommodate, each receives $30 million. Else, if A chooses Price war, each loses $10 million (i.e., think of this as 一10).

(i) (1 point) Write down the extensive-form game. [Note: It is su伍cient to draw a game tree specifying players’names at the decision nodes, choices in the branches, and payo![]() s at the terminal nodes]

s at the terminal nodes]

(ii) (1 point) Solve the game using backward induction and write down the associated (a) pure strategy proile, and (b) behavioural strategy proile

(iii) (1 point) Now consider the normal-form game where payo![]() s are as stated above but A and B are moving simultaneously. Draw the payo

s are as stated above but A and B are moving simultaneously. Draw the payo![]() matrix with A being the row player and B is the column player and ind all Nash equilibria (in both pure and mixed strategies).

matrix with A being the row player and B is the column player and ind all Nash equilibria (in both pure and mixed strategies).

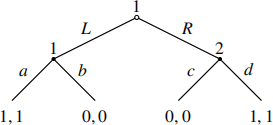

Exercise 2. [3 points] Consider the following perfect information game:

(i) (1 point) Solve the game using backwards induction and write down the behavioural strategy proile and the pure strategy proile (that conforms with backward induction)

(ii) (0.5 points) Now consider the normal form representation of the game. Draw the payo![]() matrix with player 1 as the row player and player 2 as the column player.

matrix with player 1 as the row player and player 2 as the column player.

(iii) (0.5 points) State all Nash equilibria in pure strategies.

(iv) (1 point) Are all Nash equilibria in (ii) admissible? Explain.

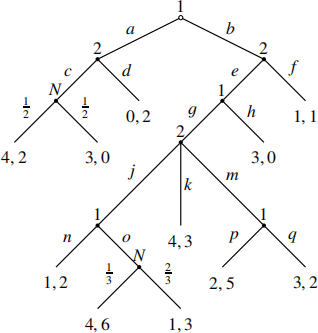

Exercise 3. [3 points]Solve the following perfect information game using backwards induc- tion. As a part of your answer, you need to state what each player chooses at each node and why.

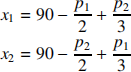

Exercise 4. [3 points] Two companies are selling software which are imperfect substitutes of each other. Let p1 and x1 denote the price and the quantity sold of software 1. Similarly, let p2 and x2 denote the price and the quantity sold of software 2 respectively. Demand for x1 and x2 are respectively given by

Each company has incurred ixed cost for designing their software and writing the programs, but the cost of selling to an extra user is zero. Therefore each company will maximize its proits by choosing the price that maximizes its total revenue (which is same as its total proit in this case)

(i) (0.5 points) Write payof functions for the two companies [note: these will be in terms of p1 and p2]

(ii) (1 point) Suppose company 2 chooses p2 = 90 with probability 0.5 and p2 = 180 with probability 0.5? What is the best response for company 1?

(iii) (1.5 points) Suppose company 1 locks in its price irst. Company 2 sets price after company 1 has locked in its price. What price will company 1 choose to maximize its revenue?

Exercise 5. [not for submission] Recall Traveller’s Dilemma. Consider a slight variation of the game where the airline manager asks Lucy to say a number irst and Pete can go next. Pete will know what Lucy says when he states the price of the gift. Assume both Pete and Lucy are interested in maximizing just their own payofs.

. What number will Lucy say? What about Pete?

![]() What will Lucy and Pete get?

What will Lucy and Pete get?

Brie![]() y explain your response to (i) and (ii). [Hint: One way to think about it is that suppose Lucy says L ∈ {2, 3, ..., 100}. What is Pete’s best response? Anticipating that what will Lucy say.]

y explain your response to (i) and (ii). [Hint: One way to think about it is that suppose Lucy says L ∈ {2, 3, ..., 100}. What is Pete’s best response? Anticipating that what will Lucy say.]

Exercise 6. [Not for submission] Three oligopolists operate in a market with inverse demand given by

where Q = q1 + q2 + q3 and qi is the quantity produced by irm i. Each irm i’s cost function is given by

and no ixed cost. Each irm’s proit is given by

The irms choose their quantities dynamically as follows: (1)First, irm 1, who is the industry leader, chooses q1 (2) Subsequently, irms 2 and 3 observe 1 and then simultaneously choose q2 and q3 respectively.

![]() Find the unique subgame-perfect Nash equilibrium (SPNE) of this game.

Find the unique subgame-perfect Nash equilibrium (SPNE) of this game. ![]()

How much proit does each irm earn in SPNE?

2023-03-04