ACC1110 Practice Midterm Questions Set A

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACC1110 Practice Midterm Questions Set A

Question One

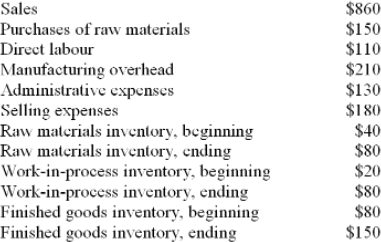

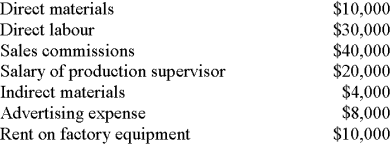

Larson Corporation uses actual costing system rather than a normal (standard) costing system. The following data have been taken from the accounting records of Larsen Corporation for the year just ended:

A. What are the total manufacturing costs for the year for Larsen Corporation? Show your work. (6 points)

B. What is the cost of goods manufactured for Larsen Corporation: Show your work. (4 points)

C. What is the cost of goods sold for Larsen Corporation? Show your work. (4 points)

D. Prepare an income statement for Larsen Corporation for the year ended: (5 points)

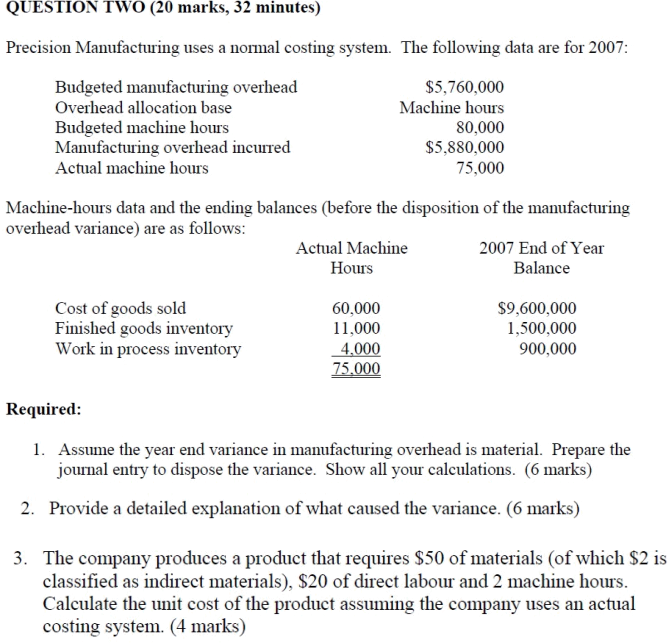

QUESTION 3

ABC Company's total overhead costs at various levels of activity are presented below:

|

|

Machine Hours |

Total Overhead costs |

|

March April May June |

60,000 50,000 70,000 80,000 |

$216,800 194,000 239,600 262,400 |

Assume that the overhead costs above consist of utilities, supervisory salaries, and maintenance.

At the 50,000-machine-hour level of activity, these costs are presented below:

|

Utilities (V) Supervisory Salaries (F) Maintenance (M) Total overhead costs |

$54,000 62,000 78,000 $194,000 |

|

V = variable; F = fixed; M=mixed |

|

The company wants to break down the maintenance cost into its basic variable and fixed cost elements.

Required:

a) Estimate the maintenance cost for June. (4 marks)

b) Use the high-low method to estimate the cost formula for maintenance cost. (4 marks)

c) Estimate the total overhead cost at an activity level of 55,000 machine hours, using the separate estimates you obtained for its components. (4 marks)

d) Show how you would estimate the total overhead cost at an activity level of 55,000 machine hours, independent of the separate estimates you obtained for its components. (that is, act as if you do not have the information in the second table). (3 marks)

Question 4

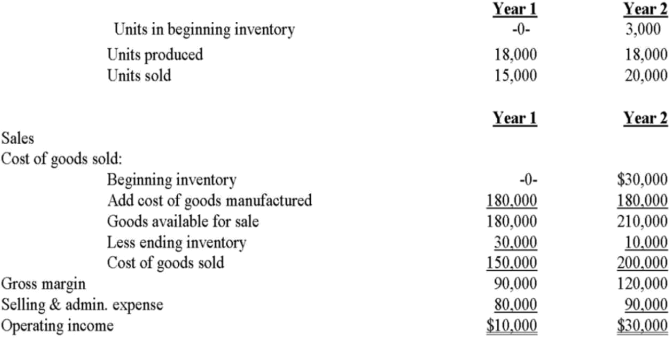

Ingersol Draperies makes custom draperies for homes and businesses. The company uses an activity- based costing system for its overhead costs. The company has provided the following data concerning its annual overhead costs and its activity cost pools:

Distribution of Resource Consumption:

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs. The amount of activity for the year is as follows:

Required:

a) Prepare the first-stage allocation of overhead costs to the activity cost pools by filling in thetable below:

b) Compute the activity rates (i.e., cost per unit of activity) for the Making Drapes and JobSupport activity cost pools by filling in the table below:

c) Compute the total overhead assigned to a job that involves making 71 metres ofdrapes.

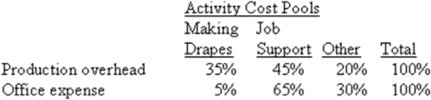

Question 5

Operating data for Fowler Company and its absorption costing income statements for the last two years are presented below:

Variable manufacturing costs are $6 per unit. Fixed manufacturing overhead totals $72,000 in each year. This overhead is applied at the rate of $4 per unit. Variable selling and administrative expenses were $2 per unit sold.

Required:

a) What was the unit product cost in each year under variable costing?

b) Prepare new income statements for each year using variable costing.

c) Reconcile the absorption costing and variable costing operating income for each year.

Multiple Choice:

These questions are of medium to high difficulty. They are meantfor practice and are not necessarily representative of what you wouldfind on the midterm exam. They arefor practice only.

1. Kelsh Company uses a predetermined overhead rate based on machine hours to apply manufacturing overhead to jobs. The company has provided the following estimated costs for next year:

Kelsh estimates that 5,000 direct labour hours and 10,000 machine hours will be worked during the year. What will be the predetermined overhead rate per hour?

A. $6.80.

B. $6.40. C. $3.40.

D. $8.20.

($20,000 + 4,000 + 10,000)/10,000 hrs. = $3.40/hr.

2. Worrell Corporation has a job-order costing system. The following debits (credits) appeared in the Work in Process account for the month of March:

Worrell applies overhead at a predetermined rate of 90% of direct labour cost. Job No. 232, the only job still in process at the end of March, has been charged with manufacturing overhead of $2,250. What was the amount of direct materials charged to Job No. 232?

A. $2,250.

B. $2,500. C. $4,250.

D. $9,000.

WIP ending inv. = 12,000 + 40,000 + 30,000 + 27,000 - 100,000 = $9,000

DL = 2250/.9 = $2,500 DM = $9,000 - 2500 - 2250 = $4,250

3. Bitter Company incurs a direct labour rate of $15 per hour applies overhead to jobs on the basis of $1.25 per direct labour hour. If Job 107 shows $86,000 of direct material and $10,000 of manufacturing overhead applied, what is the total cost ofjob 107?

A. $96,000.

B. $120,000.

C. $130,000. D. $216,000.

DL hours worked = $10,000/$1.25 per hour = 8,000 hours.

Total cost = $86,000 + (8,000 hrs. @ $15/hr) + $10,000 = $216,000

Use this information for questions 4-7.

Mallet Company has only Job 844 in process on March 1 of the current year. The job has been charged with $2,000 of direct material cost, $2,500 of direct labour cost, and $1,750 of manufacturing overhead cost. The company assigns overhead cost to jobs at a predetermined rate of 70% of direct labour cost. Any under- or overapplied overhead cost is closed out to Cost of Goods Sold at the end of the month.

During March, the following activity and amounts were recorded by the company:

Raw materials (all direct materials):

Labour:

Inventories:

Work in Process inventory contains $5,500 of direct labour cost.

4. What is the amount of direct materials cost in the March 31 work in process inventory account? A. $5,150.

B. $9,350.

C. $9,000.

D. $3,850.

DM = WIP e.i. - DL - OH applied = 14,500 - 5500 - (5500*.7) = $5,150

5. What is the cost of goods manufactured for March?

A. $67,250. B. $67,300.

C. $81,800.

D. $75,550.

2,000 + 2,500 + 1750 + 30,500 + 26,500 + (26,500*.7) - 14,500 = $67,300

6. Which of the following would be included in the entry to dispose of the under- or over applied overhead cost for the month?

A. A debit of $50 to Cost of Goods Sold.

B. A debit of $50 to Manufacturing Overhead.

C. A debit of $5,500 to Manufacturing Overhead.

D. A credit of $5,500 to Cost of Goods Sold.

OH applied = 26,500 *.7 = 18,550 less actual of 18,500 = $50 over applied.

7. What was the March 1 balance in the Raw Materials inventory?

A. $10,500.

B. $9,500.

C. $6,500.

D. $8,500.

7,500 + 30,500 - 2,950 = $8,500

8. The controller of Joy Co has requested a quick estimate of the manufacturing supplies needed for July when production is expected to be 470,000 units. Below are actual data from the prior three months of operations:

Using these data and the high-low method, what is the best estimate of the cost of manufacturing supplies that would be needed for July? (Assume that this activity is within the relevant range.)

A. $752,060.

B. $755,196.

C. $805,284.

D. $1,188,756.

VC = (853,560 - 723,060)/(540,000 - 450,000) = $1.45; FC = 853,560 - 540,000*$1.45 = $70,560. July = 70,560 + 470,000*$1.45

9. Selected information about Buehler Corporation's operations at high and at low levels of activity follow:

Level of Activity

Low High

30,000

30,000

$680,000

$5

$6

Using the high-low method, what is the total variable cost per unit of product?

A. $11.05.

B. $21.00. C. $32.00.

D. $35.00.

VC overhead = (680,000 - 575,000)/(30,000 - 25,000) = $21. Total cost of unit = $5 + 6 + 21 = 32

10. Gasson Company is a merchandising firm. Next month, the company expects to sell 800 units. The following data describe the company's revenue and cost structure:

Assume that all activity mentioned in this problem is within the relevant range.

42. What is the expected gross margin next month?

A. $11,200.

B. $14,400.

C. $16,400. D. $17,600.

800 *($40 - 18)

11. Curtis Company anticipates selling 10,000 units next year. The company wants to earn an operating income equal to 10% of sales. If variable expenses are $12 per unit, and fixed expenses total $78,000 per year, what selling price must be established to achieve the desired level of operatingincome?

A. $19.80 per unit.

B. $18.00 per unit.

C. $21.78 per unit.

D. $22.00 per unit.

Sales = (120,000 + 78,000)/(1 - . 10) = $220,000. Selling Price = 220,000/10,000

12. The following information relates to Clyde Corporation, which produced and sold 50,000 units last month.

There were no beginning or ending inventories. Production and sales next month are expected to be 40,000 units. In the next month, what should the company's unit contribution margin be?

A. $16.63.

B. $3.10.

C. $7.98.

D. $13.30.

(850,000 - 140,000 - 45,000)/50,000

What is the break-even point in dollars?

A. $18,000.

B. $6,000.

C. $11,250.

D. $7,500.

$4,500/(20 - 12 - 3) *$20/unit

14. A product sells for $20 per unit and has a contribution margin ratio of 40%. Fixed expenses total $240,000 annually. How many units of the product must be sold to yield an operating income of $60,000?

A. 37,500 units.

B. 40,000 units.

C. 65,000 units.

D. 30,000 units.

(240,000 + 60,000)/(20*.40)

15. Kern Company prepared the following tentative budget for next year:

The sales manager argues that the unit selling price could be increased by 20%, with an expected volume decrease of only 10%. If Kern incorporates these changes in its budget, what should be the budgeted

operating income?

A. $66,000.

B. $90,000. C. $120,000.

D. $145,000.

New CM = 5*1.20 - 300,000/100,000 = $3/unit

Budgeted operating income = 90,000*$3 - 150,000

16. For the most recent year, Atlantic Company's operating income computed using the absorption costing method was $7,400, and its operating income computed using the variable costing method was $10,100. The company's unit product cost was $17 under variable costing and $22 under absorption costing. Atlantic produces the same number of units each year. What must have been the beginning inventory if the ending inventory consisted of 1,460 units?

A. 920 units.

B. 1,460 units.

C. 2,000 units.

D. 12,700 units.

($10,100 + $7,300 - $7,400)/$5/unit

Use this information for questions 17-18

Last year, fixed manufacturing overhead costs were $30,000, variable production costs were $48,000, fixed selling and administration costs were $20,000, and variable selling administrative expenses were $9,600. There was no beginning inventory. During the year, 3,000 units were produced and 2,400 units were sold at a price of $40 per unit. Under variable costing, what would be the operating income (loss)?

A. $6,000.

B. $4,000. C. ($2,000).

D. ($4,400).

VCGS = $48,000/3,000 * 2,400 = $38,400. Op. income = 2,400*$40 - 38,400 - 9,600 - 30,000 - 20,000

The following data were provided by Green Enterprises for the most recent period:

17. What was the unit product cost under variable costing? A. $15.

B. $18.

C. $20.

D. $22.

18. What was the unit product cost under absorption costing?

A. $15. B. $18.

C. $20.

D. $25.

$15 + 24,000/8,000

Use this information for questions 19-20

Last year, Harris Company manufactured 17,000 units and sold 13,000 units. Production costs for the year were as follows:

Sales were $780,000 for the year, variable selling and administrative expenses were $88,400, and fixed selling and administrative expenses were $170,000. There was no beginning inventory. Assume that direct labour is a variable cost.

19. What was the contribution margin per unit?

A. $17.50. B. $25.70.

C. $27.50.

D. $32.50.

VC product cost = (153,000 + 110,500 + 204,000)/17,000 = $27.50. CM/unit = (780,000 - 13,000*27.50 - 88,400)/13,000.

20. Under absorption costing, what was the carrying value on the balance sheet of the endinginventory for the year?

A. $0.

B. $170,000.

C. $190,800.

D. $230,800.

(17,000 - 13,000) * (27.50 + 255,000/17,000)

Solutions:

Question 1

a)

|

Direct materials: |

Opening rm inventory Purchases Less ending rm inventory |

40 150 (80) 110 |

1 point 1 point 1 point |

|

Direct labour |

|

110 |

1 point |

|

Manufacturing OH |

|

210 |

1 point |

|

Total mfg costs |

|

430 |

1 point |

Deduct 1 point for each item there that shouldn’t be (eg. wip or fg inventory, selling, admin)

b)

|

COGM: |

Opening wip inventory Total mfg costs Less ending wip inventory |

20 430 (80) 370 |

1 point 1 point for correct answer OR answer from part a) 1 point 1 point |

Deduct 1 point for each item there that shouldn’t be (eg. rm or fg inventory, selling, admin)

c)

|

COGS: |

Opening fg inventory Cost of goods manufactured Less ending fg inventory |

80 370 (150) 300 |

1 point 1 point for correct OR answer from part b) 1 point 1 point |

Deduct 1 point for each item there that shouldn’t be (eg. rm or wip inventory, selling, admin)

d)

|

Sales Less COGS Gross profit Less admin Less selling Net Income |

860 (300) 560 (130) (180) 250 |

1 point 1 point for correct answer OR student answer from part b) 1 point |

2023-03-02