MATH-GA_2800 TRADING ENERGY DERIVATIVES Homework #2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

TRADING ENERGY DERIVATIVES – MATH-GA_2800

Homework #2 – Construct Risk Premia Strategies

Due Feb’20 (before 5pm)

DESCRIPTION

The objective is to analyze the performance of carry and momentum strategies for oil futures:

· 100 WTI contracts for each of the two strategies

· Investment period: 01/01/2010-12/31/2022

· Trades are entered at the closing price on the day when the signal is calculated

· Roll ![]() to

to ![]() at the closing price on the 5th business day prior to the futures expiration (the same as in Homework #1)

at the closing price on the 5th business day prior to the futures expiration (the same as in Homework #1)

· Transaction costs: $0.01/bbl

ASSIGNMENT

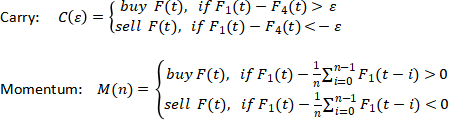

Carry and momentum strategies are defined as follows:

![]() is either

is either ![]() or

or ![]() contract, depending on the rolls, like in Homework 1.

contract, depending on the rolls, like in Homework 1.

1) Implement base carry and momentum strategies

- Implement base carry strategy ![]() for

for ![]()

- Implement base momentum strategy ![]() for

for ![]() (one month)

(one month)

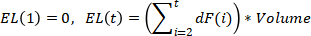

- For each strategy construct and graph equity line ![]() which is cumulative strategy P&L

which is cumulative strategy P&L

(Start the line at zero; ![]() is daily P&L from rolled futures like in Homework 1; include transaction costs):

is daily P&L from rolled futures like in Homework 1; include transaction costs):

The strategy can be implemented either in Excel or Python. If you choose to use Python, then provide detailed strategy output in Excel.

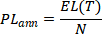

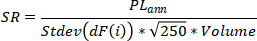

2) For each strategy, calculate the following performance metrics:

- Average Annual ![]()

- Annualized Sharpe Ratio ![]() :

:

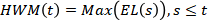

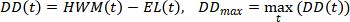

- High water-mark:

- Drawdown is the distance from ![]() :

:

(When ![]() is graphed, it is shown with a negative sign as

is graphed, it is shown with a negative sign as ![]() to show it as loss)

to show it as loss)

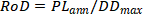

- Return on Drawdown:

3) Determine optimal parameters for each strategy

- For ![]() , find carry strategy

, find carry strategy ![]() that maximizes Sharpe ratio

that maximizes Sharpe ratio

- For ![]() , find momentum strategy

, find momentum strategy ![]() that maximizes Sharpe Ratio

that maximizes Sharpe Ratio

If optimal ![]() and

and ![]() are not unique, then you can use any of the optimal ones at your discretion

are not unique, then you can use any of the optimal ones at your discretion

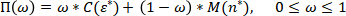

4) Construct a mini-portfolio of two strategies

- Define portfolio as

and find the strategy allocation ![]() that maximizes Sharpe Ratio for the portfolio.

that maximizes Sharpe Ratio for the portfolio.

- Graph equity line ![]() for the optimal portfolio

for the optimal portfolio ![]() .

.

5) Summarize results of 2)-4) in the Word document, and comment on strategy and portfolio performances.

Submit the strategy implementation file in 1) and summary of results 5) to NYU Brightspace.

2023-02-21

Construct Risk Premia Strategies