Econ 20A Problem Set 1

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

Problem Set 1

Econ 20A

Due date: Feb 8

1) For each of the following transactions, determine if it takes place in the market for goods and services or the market for factors of production. Then, determine the direction of the flow of goods and services and the flow of money between households and firms.

a. Labanya purchases a robotic vacuum cleaner on Amazon for $375.

b. Matt gets paid $3,000 to teach a creative writing class at his local community college.

c. Dollar General hires 10 new workers at the federal minimum wage to staff a new store.

d. 96 million people purchased a monthly Spotify premium subscription for $10 last month.

2) A U.S.-owned automobile factory uses $50 million worth of materials produced in the U.S. and $10 million worth of material purchased from foreign countries to produce $100 million of automobiles. $70 million worth of these automobiles are purchased by U.S. consumers, $25 million are sold in foreign countries, and $5 million are added to inventory. How much of this production is included in U.S. GDP and in which component?

3) The country of Batavia produces only chocolates and watches. Below is a table with recent information on Batavia production and prices. The base year is 2009.

Prices and Quantities

|

Year |

Price of A Box of Chocolates |

Boxes of Chocolates |

Price of Watches |

Quantity of Watches |

|

2008 |

$4 |

100 |

$50 |

10 |

|

2009 |

$5 |

90 |

$50 |

15 |

|

2010 |

$5 |

100 |

$60 |

15 |

|

2011 |

$6 |

80 |

$65 |

12 |

a. What was nominal GDP, real GDP, and the GDP deflator for 2008? Show your work.

b. What was nominal GDP, real GDP, and the GDP deflator for 2009? Show your work.

c. What was nominal GDP, real GDP, and the GDP deflator for 2010? Show your work.

d. What was the inflation rate for 2010? Show your work.

4) You bought an old car a couple years ago for $1,000 and put about $5,000 of new parts and paid mechanic costs into improving it. You sold it yesterday for $3,000. How does this sale affect GDP? Explain.

5) Using the Federal Reserve Economic Data (FRED) database (https://fred.stlouisfed.org/), let’s sum up real GDP using its components. Recall that GDP = C + I + G + Net Exports, so start by finding “Real personal consumption expenditures” (C), use the “Billions of Chained 2012 Dollars, Quarterly (average), Seasonally Adjusted Annual Rate” series. Now click Add Line and find a similar series for Real Gross Private Domestic Investment (I); Real Government Consumption Expenditures and Gross Investment (G); and Real Net Exports of Goods and Services (NX).

a. Graph the result for years after 2000.

b. In the 2009 recession which series fell by the most?

c. In the first quarter of 2010, what share of GDP was made up by Consumption?

6) Explain how each case impacts GDP and its components.

a. The U.S. government pays $1 billion to Saudi Arabia for crude oil to add to U.S. official oil reserves.

b. The U.S. government buys a U.S. produced car for its ambassador in Sweden.

7) In a simple economy, people consume only 2 goods, food and clothing. The market basket of goods used to compute the CPI consists of 50 units of food and 10 units of clothing.

|

|

Food |

Clothing |

|

2002 price per unit |

$4 |

$10 |

|

2003 price per unit |

$6 |

$20 |

a. What are the percentage increases in the price of food and in the price of clothing? What is the average of the two numbers?

b. What is the percentage increase in the CPI?

c. The percentage increase in the CPI is different from the average of the percentage increases. What does this tell us?

d. Do these price changes affect all consumers to the same extent? Explain.

8) For each scenario below, determine which challenge of measuring the true cost of living—quality improvements, new products, or substitution bias—a price index constructed 15 years ago would

experience.

a. A typical family owns more cell phones and fewer landline telephones than it did a decade ago. The average price of a cell phone plan is lower than that of a residential line.

b. Very few households had high-speed internet connections 15 years ago. Now most households do and the average price has fallen each year.

c. Over the last 10 years, personal computers have gotten faster and acquired many new features that enable users to perform many more tasks.

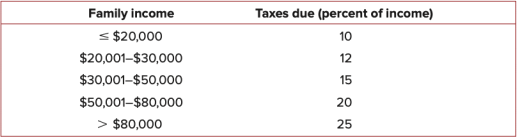

9) Consider the table below. It shows a hypothetical income tax schedule, expressed in nominal terms, for the year 2014:

The legislature wants to ensure that families with a given real income are not pushed up into higher tax brackets by inflation. The CPI is 175 in 2014 and 185 in 2016. How should the income tax schedule above be adjusted for the year 2016 to meet the legislature’s goal?

2023-02-21