EC413 HW2

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

EC413 HW2

1. Planned Obsolescence Waldman (1993). Show as much work as possible.

(a) Read & summarize the Introduction.

(b) Write down the model (all agents, valuations, available actions, etc.).

(c) Under price paths with commitment, write down the maximum social surplus from

i. No Switch (Monopolist produces A both periods)

ii. Switch and 1 buys B (Monopolist produces A, then B in period 2, Group 1 buys B)

iii. Switch and 1 doesn’t buy B (Monopolist produces A, then B in period 2, Group 1 doesn’t buy B)

iv. Derive conditions on VA , VB , N , c for when No Switch provides higher social surplus than the other two options.

v. Interpret this scenario.

(d) Under price paths with no commitment (from the Monopolist’s perspective starting at period 2), assume that the Monopolist can perfectly price discriminate. Compute the Monopolist’s profit maximizing action in each of the three scenarios above

(e) Derive 2 conditions for when both switching scenarios provide higher revenue than No Switch.

(f) Write down values of VA , VB , N, and c for when No Switch is provides the highest social surplus, but switching is preferred by the Monopolist.

(g) Explain the importance of positive network effects here.

(h) Write down three things you think is missing from the model.

2. Two-Part Tariff Oi (1971) Section I.

(a) Write down Disneyland’s two-part tariff problem.

(b) Write down the demand function for each agent.

(c) P is the price for each park ride. What is the optimal P?

(d) T* is the optimal tariff. What is the optimal T* ?

3. Bundling Adams and Yellen (1976) A firm is selling good 1 and good 2. Pat wants to purchase at most one of each object, and has valuation v1 for good 1, v2 for good 2, and v1 + v2 for both. If Pat purchases good k for pk , then Pat receives utility vk − pk (and similarly for bundles). The firm has 3 options for selling to Pat:

(a) Pure Components Firm sells goods separately at price p1 and p2 . Pat can choose to either 1) buy

only good 1, 2) buy only good 2, 3) buy both goods, or 4) buy nothing.

i. Write out Pat’s utility in each option.

ii. Let v1 < p1 and v2 > p2 . Which option will Pat choose? Show why.

(b) Mixed Bundling Firm sells goods 1 and 2 separately at price p1 and p2 , and together as a bundle

at pB (where pB < p1 + p2 ).

i. Write out Pat’s Utility in each purchase option.

ii. Let v1 > p1 and v2 < p2 .

A. Argue that Pat will not choose to purchase good 2.

B. Give a condition that guarantees Pat will choose to only purchase good 1.

C. Give a condition that guarantees Pat will choose to purchase the bundle.

![]()

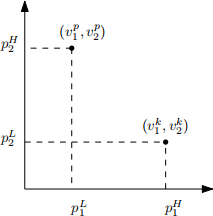

![]() (c) Two Customers Now consider the case when there are two customers Pat and Kelly. Let v1(p),v2(p),v 1(k),v2(k) be the valuations of Pat and Kelly for goods 1 and 2. Let v1(p) < v1(k) and v2(k) < v2(p) . The firm wants to take a pure components approach. It considers two possible prices for each of the goods: p1(L) = v1(p) and p1(H) = v 1(k), and p2(L) = v2(k) and p2(H) = v2(p) (Figure).

(c) Two Customers Now consider the case when there are two customers Pat and Kelly. Let v1(p),v2(p),v 1(k),v2(k) be the valuations of Pat and Kelly for goods 1 and 2. Let v1(p) < v1(k) and v2(k) < v2(p) . The firm wants to take a pure components approach. It considers two possible prices for each of the goods: p1(L) = v1(p) and p1(H) = v 1(k), and p2(L) = v2(k) and p2(H) = v2(p) (Figure).

i. Suppose that the firm price of goods 1 and 2 at (p1(L),p2(L)). What will each agent buy? Compute the firm’s revenue at this set of prices.

ii. Do the same for (p1(L),p2(H)), (p1(H),p2(L)), (p1(H),p2(H)).

iii. Give conditions for (p1(H),p2(H)) to be the firms profit maximizing set of prices.

2023-02-20