ACF2400 Accounting Information Systems

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACF2400

Accounting Information Systems

Part B – Short Answer Questions (75 marks)

Question B1

Edited for relevance

Read the case below and then answer the questions using the ethical analysis framework used throughout the semester Pharmart, a large pharmacy chain that operates across South East Asia, has a database of approximately 15 million active individual medical records about the patients it services. For example, when a patient requests medication, the pharmacist can often prevent harmful side-effects by changing the combination of drugs being administered. This is made possible because the database shows the pharmacist each patient’s medical history. Patients can also request a statement showing details of purchases to request reimbursement from a health insurance provider. In a recent management team meeting, the head of sales and marketing discussed a business proposal made by a major insurance company to access the database for $50 per record. The justification for the proposal is that the scheme will be of benefit to patients because:

• Claims made by existing customers of the insurance company will be able to be processed more efficiently, saving both the customer and the provider significant time and effort; and

• Data sharing will allow the insurance company to identify the level of cover most suited for each customer’s needs (many are currently covered for services they will not use), and help customers access additional cover that they may not be aware of.

The Chief Executive Officer, who has been involved in negotiations, further argued that allowing an insurer to access the database to tailor products to meet patient needs is no different to allowing the pharmacist to recommend in-store products to complement the patient’s treatment. Add-on sales of non-prescription items are highly profitable, and this proposal will add significantly to profits. The Chief Information Officer does not like the idea, saying that the database is currently very secure, but giving access to another company may compromise security procedures.

a) What is the underlying ethical issue? (Note that there may be more than one ethical issue, but you only have to identify one. The underlying issue is not stated explicitly in the case)

b) Which specific interests are in conflict?

c) Describe at least two actions that should be considered and the consequences of each option.

a) What is the underlying ethical issue? (2 marks)

Award 2 marks for something similar to either of the points below:

1. Patients have not given consent for their medical records to be accessed by a third party, particularly not for commercial use. Verifying medications and recommending add-on non-prescription products for medical purposes is not equivalent to selling insurance. It is likely that this arrangement is actually illegal.

2. Once the records are available to a third party, security breaches and inappropriate use of medical records are more likely because Pharmart has little or no control over the internal workings of the insurance company.

Note that dispensing non-prescription items to assist customers is not an ethical issue. For most pharmacies in Australia (also Indonesia and other parts of the world), non-prescription sales of mundane products, such as asprin, heat packs, cold packs, and vitamin supplements, are highly lucrative. Some answers seemed to say that making a profit is unethical, or that recommending non-prescription items is dangerous. It is hard to see how either position can be defended.

b) Which specific interests are in conflict? (6 marks)

Any three from the list below (2 marks each)

The desire of Phamart’s management to turn the customer database into a profit centre is in conflict with (or potentially in conflict with):

(i) The professional obligations of pharmacists to keep medical information private

(ii) Customer expectations that privacy will be maintained

(iii)The expectations of the general public that pharmacists will be scrupulously ethical in the dealings with customers and keep details of interactions and other information disclosed private

(iv)The CIO’s desire to maintain the security of the database of patient information

(v) Expectations of shareholders that the company will at least maintain the share price, that the company will do nothing to compromise its ability to interact with customers, and that the company will not engage in (potentially) illegal activities that may incur a large fine (fines dilute shareholder wealth).

(vi)Legislation concerning informed consent to share medical records (if applicable. Note that we do not know where the company is headquartered, or even which countries the deal applies to. Some countries in this region have no effective privacy legislation, but all pharmacy guilds worldwide have privacy guidelines as part of their ethical practice principles).

The desire of the insurance company to improve efficiency and tailor products more effectively is in conflict with

(i) The professional obligations of pharmacists to ensure customer information gathered remains confidential

(ii) Privacy legislation concerning informed consent to share medical records

(iii)Customer expectations that privacy will be maintained

The CIO’s desire to maintain the security of the database is in conflict with

(i) The desire of shareholders to maximise profits

(ii) The desire of the sales manager to maximise revenue

c) options and consequences (10 marks)

Five marks for each alternative up to a max of 10 marks.

Alternatives (not exhaustive)

1. Abandon arrangement. The arrangement is merely being discussed at this stage, so no announcement will have been made, and it should not have been built into profit forecasts. Many deals fall through after rigorous discussion at the board level, particularly when analysed for feasibility (all projects have to be feasible in multiple ways: economic, legal, technical, schedule, and so on).

Nevertheless, from one perspective, abandoning the deal can be considered a lost opportunity, both because it eliminates a potential revenue stream for Pharmart, and prevents the insurance company from enhancing service for its customers.

On the other hand, abandoning the arrangement will maintain the security of the database, maintain the trust and goodwill of customers and employees, not expose the company to adverse publicity, and not expose the company to fines or directors to criminal prosecution), and not create long-term value problems for shareholders (loss of goodwill, loss of assets).

There is no guarantee that the actions of the insurance company will be genuinely of benefit to customers, so abandoning the arrangement also eliminates the likelihood that the patient database could be used in ways that will damage Pharmart or cause harm to cusomers.

2. Sell the data.

a) This will provide a lucrative source of revenue, and customers might appreciate having a streamlined claim system that is integrated with the pharmacy system. However, if the sale of data is conducted without the consent or knowledge of customers, a number of adverse outcomes are possible:

i. Pharmacy staff are likely to be unhappy because the sale represents a breach of their professional ethical practice requirements

ii. The database will be less secure, partly because access is being provided to an outside party (although it is relatively easy to enable a secure transfer of data), but mainly because as soon as customer data is in the hands of an external party, Pharmart has no control over how it will be used.

iii. If no consent to share is provided and customers find out that their medical data is being sold (e.g. via a whistle blower pharmacist), customers are likely to be unhappy. This will probably affect business in some way, and will certainly affect the reputation of the company. In a worst case scenario, the loss of goodwill will affect company value (lower sales, lower share price, possible fines), resulting in a lower investment value/return for shareholders.

iv. Customers may receive unwanted communications from the health insurance company as it promotes its products. This will be particularly problematic if the insurance company targets vulnerable groups with seemingly attractive offers.

Question B2

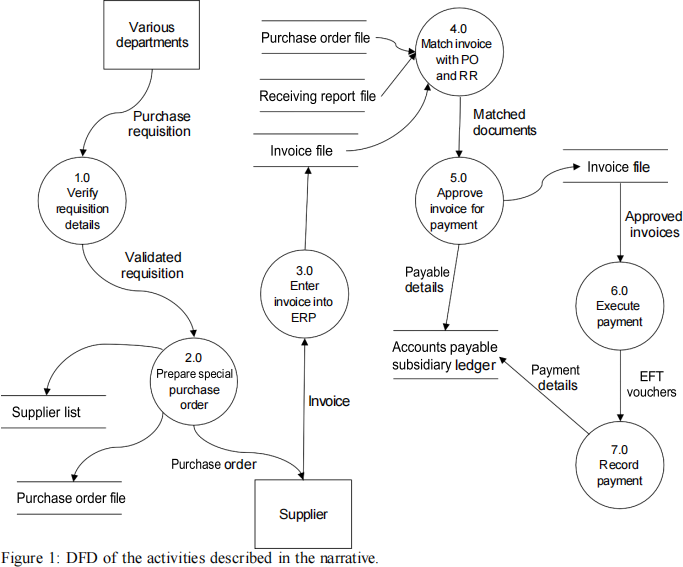

Selloc Ltd. sometimes orders items that are not kept as part of inventory (e.g. desks, chairs, filing cabinets). It performs its order and payment activities for these non-inventory orders and payments using itsintegrated Enterprise Resource Planning (ERP) system. The operation of the system is described below followed by a Data Flow Diagram (DFD) of the activities (Figure 1):

• Because the items concerned are not inventory, the accounts payable clerk, rather than the inventory purchasing manager, handles the activity. As the first step, when a purchase requisition is received, the accounts payable clerk checks that the requisition has been authorised by the relevant head of department and that all required information is present. The clerk further checks that the requisition nominates the supplier with the cheapest price for that item.

• Because purchase of these items is infrequent, the suppliers of these items are generally new suppliers. The accounts payable clerk verifies supplier details and creates a supplier record. The requisition information is then keyed into the computer system and a purchase order record created. That order is emailed to the supplier.

• When a supplier invoice is received, the accounts payable clerk enters details into the ERP.

• The ERP system performs an automatic three-way match of the supplier invoice with the corresponding purchase order (PO) record and receiving report (RR) record to check that the supplier, item, quantity, and price agree across all documents. If all documents are present and all details agree, the ERP adds the approval task to the accounts payable clerk’s workflow.

• The clerk then reviews the transaction documentation and, if there are no problems, updates the status of the invoice to ‘approved for payment’ and updates the accounts payable subsidiary ledger to record the liability.

• Each Friday, the ERP adds to the financial accountant’s workflow the list of approved supplier invoices that are due for payment within the next week. All payments are via electronic funds transfer (EFT), and the financial accountant and the financial controller are the only employees authorised to pay funds. When a payment is made, the ERP stores a copy of the EFT voucher in a file and notifies the accounts payable clerk of the payment.

• On receipt of the notification, the accounts payable clerk updates the accounts payable subsidiary ledger.

Required

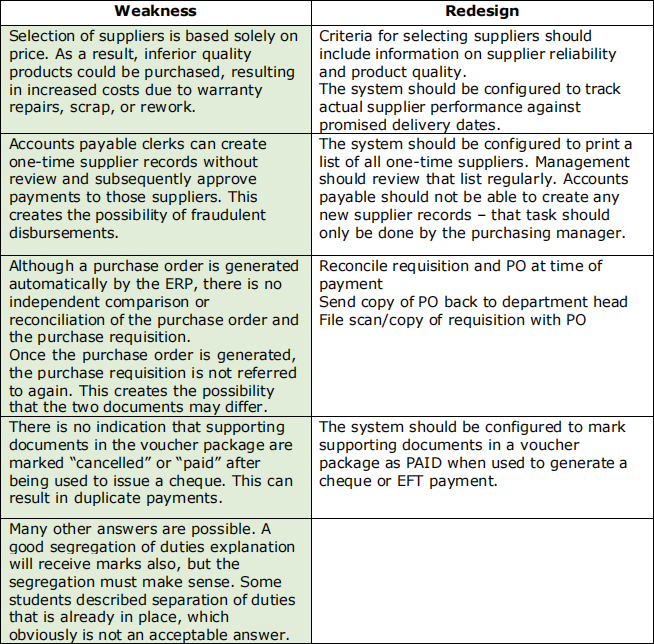

a. Describe three (3) internal control weaknesses in the above process.

b. Describe three (3) ways in which the system can be redesigned to reduce the scope for fraud and other opportunistic behaviours.

(9 + 9 = 18 marks)

Question B3

irrelevant

One of the normal contract requirements of being a supplier to Target, Kmart, and other large retailers, is that the supplier manage store inventory using the retailer’s vendor-managed inventory (VMI) system. These systems typically provide detailed information about sales and inventory holdings of the supplier’s products at each store. The requirement to manage inventory applies regardless of whether the supplier is a small home-based business, or a large multi-national firm. For example, Worm Affair, a small business that supplies worm farm products, accesses essentially the same type of information as Sony Corporation in its dealings with Kmart.

Required: deleted

(8 + 4 + 8 = 20 marks)

Question B4

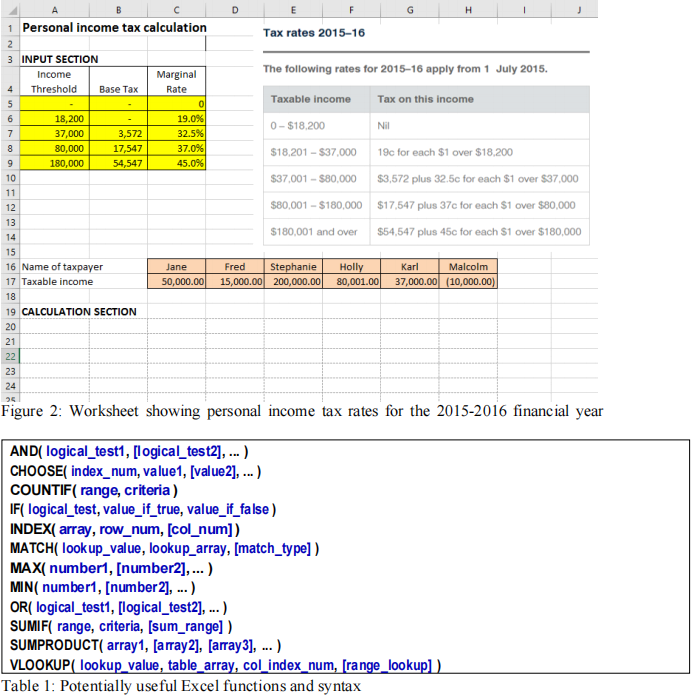

The worksheet in Figure 2 below shows the progressive personal income tax rates for Australian citizens for the 2015-2016 financial year. The information in cells A5 to C9 corresponds to the explanation on the right-hand side. Below Figure 2, a table of Excel functions and the syntax of each (as it would appear in Excel) is provided to assist you in completing this question.

Required

Show the row headings (Column A) and the formulas required in Column C to calculate the tax payable on Jane’s income of $50,000. The formulas you construct:

• must be able to be copied to columns D:H without the need for manual editing; and

• must conform to the spreadsheet design principles we covered throughout the semester.

(17 marks)

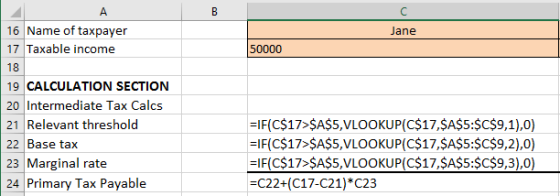

Solution based on tutorial exercise

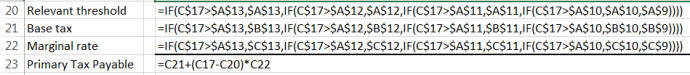

Alternative (nested IF)

Marking guide:

The solutions above are only suggestions, but the solution needs some way to determine the threshold, the base amount payable for the income, and the marginal rate. An important part of the solution is to have an IF to test for negative income.

Although not the ideal solution, a workable series of nested IFs should receive full marks because that approach demonstrates competence with an important formula.

Calculations for threshold, base amount payable, and marginal rate:

5 marks each calculated as:

VLOOKUP

Correct lookup value 1

Correct Range 1

Correct column number 1

Correct relative/absolute refs 1

Correct use of IF (one of the income amounts is negative, so an IF is needed to catch this exception) 1

primary tax payable calculation: 1-2 marks (base tax, earnings above base, rate to apply to earnings above base)

2023-02-06