BUS5002 - Fundamentals of Business Analytics

BUS5002 - Fundamentals of Business Analytics

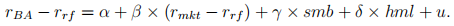

1. (45 points) Let us explore again the CAPM model. The regression model to be inves-tigated is

where  is the return of Boing asset,

is the return of Boing asset,  is the risk free return,

is the risk free return,  is the market return, and u is the error term.

is the market return, and u is the error term.

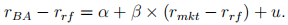

(a) (5 points) Estimate α and β and report the estimated values in the table below.

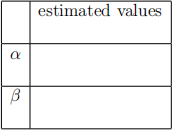

(b) (15 points) Test if the errors is heteroskedastic using the Breusch-Pagan test. Report the p-value of the test, and according to the p-value answer if the errors are heteroskedastic or not.

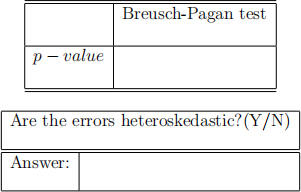

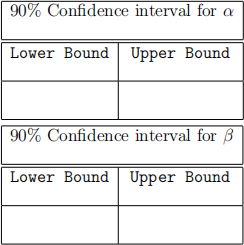

(c) (10 points) Estimate the 90% confidence interval for α and β, assuming that the errors are heteroskedastic

(d) (15 points )Test the validity of the CAPM model together with the assumption that Boing is a neutral asset. Write down the null assumption of your test, report the p-value of the test, and if you reject or not the null assumption. Assume that the errors are heteroskedastic (Hint: if the CAPM is valid, then there is no intercept in the regression model (1)).

2. (55 points) Let us explore again the Fama-French extended version of CAPM model. The regression model to be investigated is

where  are defined in the previous question, and smb and hml correspond to SMB and HTM defined in the Table of the final exam preliminaries file. The errors are assumed to be heteroskedastic.

are defined in the previous question, and smb and hml correspond to SMB and HTM defined in the Table of the final exam preliminaries file. The errors are assumed to be heteroskedastic.

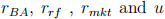

(a) (10 points) Estimate

and report the estimated values on the table below.

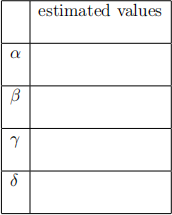

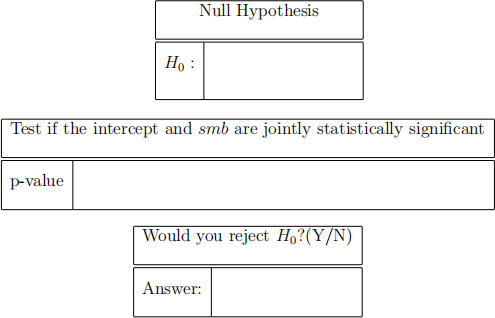

(b) (15 points) Test if the intercept and smb are jointly statistically significant. Write down the null assumption of your test, report the p-value of the test, and if you reject or not the null assumption.

(c) (15 points) Estimate the following regression

Among models (1), (2) and (3), which one you prefer most? Explain your answer. (Hint: waldtest)

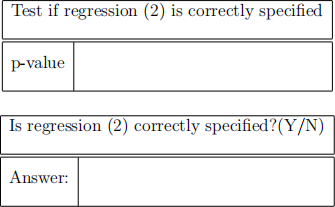

(d) (15 points) Test if the regression model (2) is correctly specified. Report the p-value of the test and your conclusion based on the p-value

2021-05-24