ECON 3371 Econometrics

ECON 3371 Econometrics

Final Exam Preliminaries - Business Analytics - ECON5002, Semester II 2019

The final exam has two computer questions. You will need to submit only one R-code script electronically via LMS on the day of the exam by 13:00pm. Label your file as < initial last name>_<initial given name> .r. I should be able to run your script file and reproduce the results that you will report in the exam.

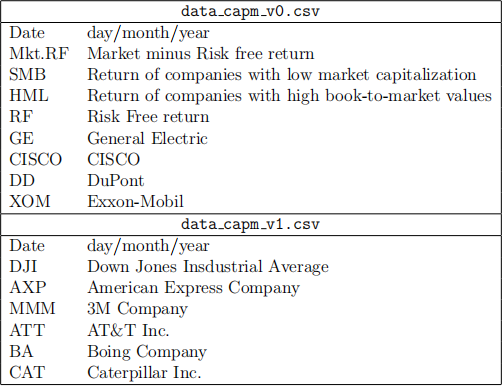

The data_capm_v0.csv and data_capm_v1.csv files contains the data. They have obser-vations from daily rates of return comprising the period of January 2007 to December 2013. The variables in each of the files are described below:

You need to use the file FExam_pre.r as the preamble of your code.

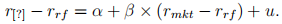

1. Let us explore again the CAPM model. The regression model to be investigated is

where

is the return of one asset to be informed on the exam paper,

is the risk free return,

is the market return, and u is the error term. You should be able to:

(a) Merge both data files, and obtain a summary statistics of each of the return series.

(b) Produce a scatter plot with

on the y-axis and

on the x-axis, and include the regression line in it.

(c) Estimate α and β.

(d) Estimate confidence intervals for α and β assuming heteroskedasticity of the vari-ance of the errors.

(e) Perform hypothesis testing on the parameters of the model (single or joint rescric-tions) assuming heteroskedasticity of the variance of the errors.

(f) Test if the errors are heteroskedastic and autocorrelated (Breustch-Pagan and Breusch-Godfrey tests), and interpret the results.

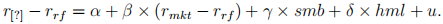

2. Let us explore again the Fama-French extended version of CAPM model. The regres-sion model to be investigated is

where

are defined in the previous question, and smb and hml correspond to SMB and HTM defined in the above Table. You should be able to:

(a) Estimate

.

(b) Plot the object class lm, which is obtained after performing the regression (you will generate 4 graphs).

(c) Estimate confidence intervals for

assuming heteroskedasticity of the variance of the residuals.

(d) Perform hypothesis testing on the parameters of the model (single or joint rescric-tions) assuming heteroskedasticity of the variance of the errors.

(e) Perform hypothesis testing on the parameters (single or joint rescrictions) as-suming heteroskedasticity of the the variance of the residuals

(f) Perform model comparision tests, considering that one or more models are nested into a large model (waldtest).

(g) Test if the model is correctly specified (reset test).

2021-05-24