ACCT10002 Introduction to Financial Accounting Summer 2023 Topic 6 Exercises

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

ACCT10002 Introduction to Financial Accounting

Summer 2023

Topic 6 Exercises

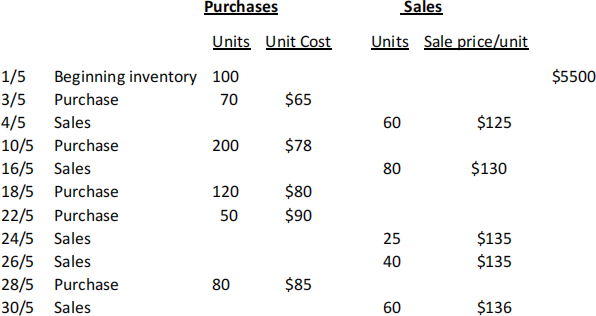

1. Variety Ltd. sells many products and uses the perpetual inventory system. Soccer balls are one of its popular items. Below is an analysis of the inventory purchases and sales of soccer balls for the month of May.

Note: A physical stocktake found a shortage of 2 soccer balls to the computer records

Required:

Using the moving weighted average cost assumption,

(i) Complete the inventory record for the May transactions [5 marks]

(ii) Prepare the required journal entries for the stock shortage [1 mark]

(iii) Calculate the cost of sales to cost of sales for May [2 marks]

(iv) Calculate the ending inventory valuation for May [1 mark]; and

(v) Calculate the Gross Profit for May [1 mark].

[An answer Sheet is provided]

2. Robertson Ltd uses the allowance method to record doubtful debts expense and concludes, using the percentage of accounts receivable method, that 1% of accounts receivable will become uncollectable. Accounts receivable are $650,000 at the end of the year, and the Allowance for Doubtful Debts had an opening balance of $7,900 at the beginning of the year and during the year the actual bad debts written off were $3,000.

Required:

(a) Prepare the adjusting journal entry to record doubtful debts expense for the year.

(b) If the Allowance for Doubtful Debts had an opening balance of $7,000 and actual bad debts during the year were $6,900 determine the amount to be reported for doubtful debts expense.

2023-01-31