ECON1002 Principles of Macroeconomics

ECON1002 Principles of Macroeconomics

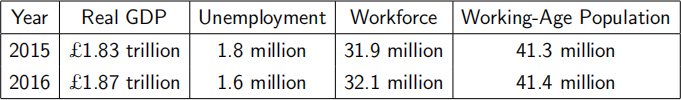

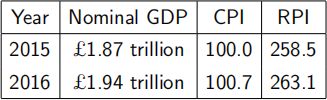

1. Consider the following data on the UK economy:

Real variables

Nominal variables

where the base years are 2013(Real GDP), 2015(CPI) and 1987(RPI).

(a) Find the unemployment rate in 2015, and the number of people in employment in 2016. [10%]

(b) Find CPI and RPI inflation during 2015-16. Why did Nominal GDP grow faster than Real GDP during this period? Explain. [10%]

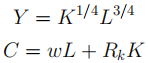

2. A competitive firm has the following production and cost functions:

where K is physical capital, and L is the number of workers. The firm sells its output at a fixed price  . It pays workers a wage rate w, and the cost of renting a unit of capital is

. It pays workers a wage rate w, and the cost of renting a unit of capital is  .

.

(a) Find an expression for the profit function of the firm. What are the marginal products of capital and labour? [10%]

(b) Set up the firm’s profit maximization problem and solve for the optimal capital-labour ratio and the wage rate. [10%]

(c) Does the above production function display diminishing returns? Explain. Would you reach the same conclusion if the production function were Y = 2KL? [10%]

3. One-year government bonds issued on Jan 1st 2019 promise to pay £50 a year until they reach maturity on Jan 1st 2020. The interest rate at issuance was 2.5% per year.

(a) Find the bond price on Jan 1st 2019. If interest rates subse-quently increase to 5% per year, what will happen to the price of one-year bonds? [10%]

(b) How would you expect rising interest rates to affect the liquidity and net worth of banks holding government bonds? Explain. [10%]

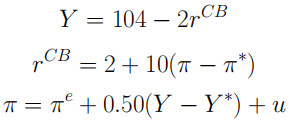

4. Consider the following 3-equation model:

where Y is output,  is inflation,

is inflation,  , and

, and  .

.

Expected inflation is given by  , and

, and  is the output gap. The variable

is the output gap. The variable  is the interest rate set by the central bank. We may interpret

is the interest rate set by the central bank. We may interpret  as the central bank’s inflation target.

as the central bank’s inflation target.

(a) Which equation is the IS curve, and which is the New Keynesian Phillips curve? Provide a brief economic explanation for the negative relationship between Y and

in Equation (1). [10%]

(b) What does the variable u represent? Find equilibrium inflation, output and interest rates when u = 0. [10%]

(c) Now suppose u = 0.3. Find equilibrium inflation, output and interest rates. Does the central bank behave like a strict or flexible inflation targeter? [10%]

END OF PAPER

2021-05-23