4QQMN501 Introduction to Financial Reporting 2022/23

Hello, dear friend, you can consult us at any time if you have any questions, add WeChat: daixieit

4QQMN501 Examination 2022/23

4QQMN501 Introduction to Financial Reporting

Period 1, January 2023

Section A

Question 1 is compulsory. Please complete it.

Question 1

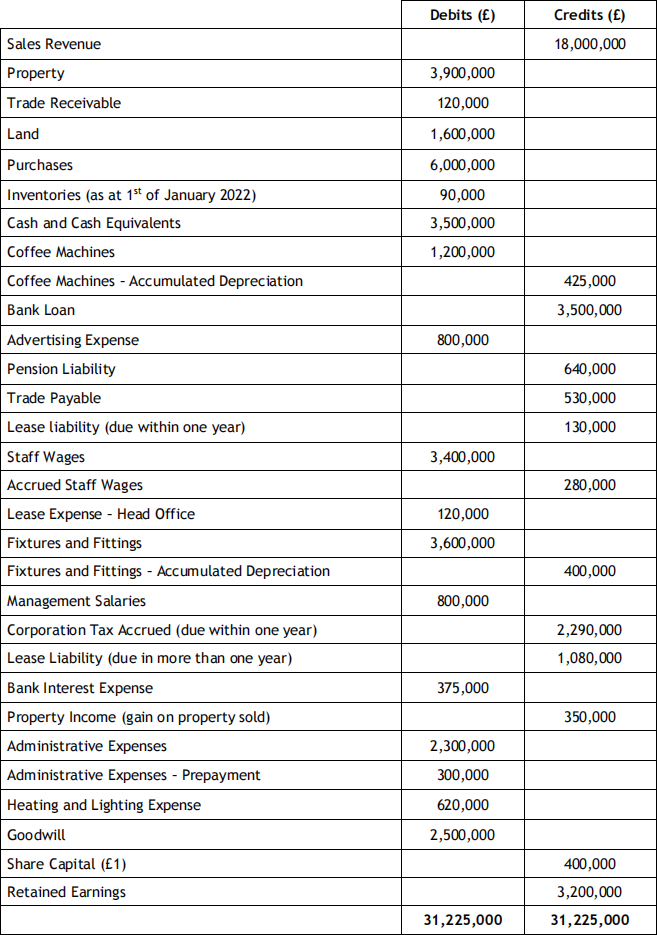

The following information is the preliminary trial balance of King’s Coffee Company Ltd for year ending of 31st of December 2022:

Adjustments

1) Closing inventories was £200,000 on the 31st of December 2022.

2) Corporation tax is 35% for the year, half due now and should be paid in cash and half due in April 2023.

3) Property was revalued from £3,900,000 to £4,500,000.

4) £1,200,000 of new land was purchased using a bank loan.

5) Depreciation (all based on reducing balance):

a) Coffee Machines – 25%

b) Fixtures and Fittings – 20%

6) A provision for bad debts needs to be added, with 10% of the trade receivables figure considered unlikely to pay.

7) £300,000 of administrative expenses shown as a prepayment is an error on the trial balance, which instead should be an accrual, with the amount relating to this financial year ending 31st of December 2022.

8) £80,000 of the heating and lighting expense shown on the trial balance should be a prepayment and relates to the next financial year.

9) Dividends were distributed to shareholders during the financial year to a value of £1,000,000 in cash.

10) A court case is currently going through the courts in which King’s Coffee Company Ltd is being sued by a customer who was injured on the premises, in which the solicitors estimate they will have to pay out £200,000 and that it is possible (less than 50% possibility) it will lose the court case.

11) A rights issue of 1 for 4 basis, at £15 per share, with 90% of shares bought by shareholders, conducted before the bonus issue.

12) A 5 for 1 bonus issue was given to shareholders. The bonus issue was conducted after the rights issue. The bonus issue should be made using a revenue reserve.

REQUIRED

Please prepare a balance sheet and income statement for 31st December 2022 using the trial balance presented on the previous page, ensuring that you make all the requested adjustments. Please also ensure to add notes of any contingent assets and/or contingent liabilities if you consider such an event to have arisen.

Total marks for Question 1 (40 marks)

Section B - Testing your understanding of financial reporting in an applied business context.

Answer ONE question (and all of its parts) from this section.

(e.g. all of Question 2 OR all of Question 3)

Question 2

The following are key extracts from the financial statements for Bush House Insurance PLC for financial years ending 31st of December 2021 and 2022:

Further to the information contained in the financial statements above during the 2022 financial year a dividend to ordinary shares was paid of £3,950,000 and the interest payable expense for 2022 is fully paid.

a) Please draw up the statement of cash flows for the financial year ending the 31st of December 2022, based upon the information above. (8 marks)

b) Adopting the perspective of a financial analysts, please provide a short report to your clients based upon the statement of cash flows you have just prepared, as well as using extracts of the other financial statements from the question to advise your client with either a buy or sell advice for Bush House Insurance PLC. Please draw your clients’ attention to three specific areas that you think is important for making their investment decision and use this to justify why you advise either buy or sell. Please justify this recommendation based upon only the information contained within the financial statements in the question and the statement of cash flows which you have created . (12 marks – Suggested word count 350-450 words)

c) Building upon your answer to the previous question without repeating, please offer three examples of non-financial information contained within the wider annual statement (e.g. strategic report, management commentary) which you would seek to review to further advise your client about investing in Bush House Insurance PLC. Please link this with your previous answer and be clear on specific aspects of the wider annual report you would seek to review and why. (10 marks - Suggested word count 300-350 words) Total marks for Question 2 (30 marks)

Question 3

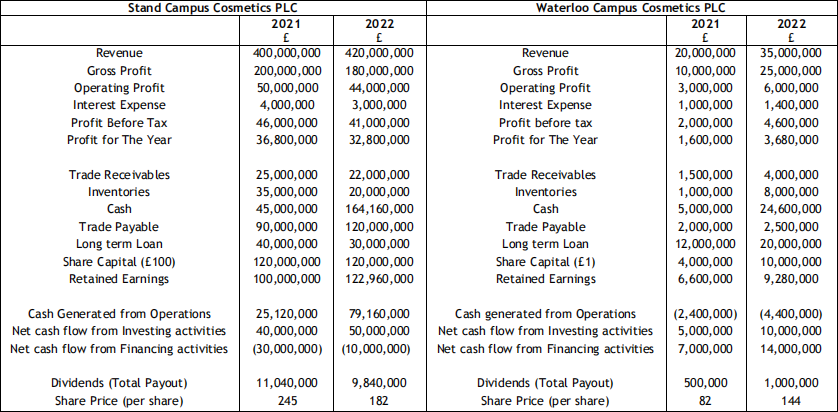

The following are key extracts from the financial statements and market data of Stand Campus Cosmetics PLC and its competitor Waterloo Campus Cosmetics PLC for financial years ending 31st of December 2021 and 2022:

a) Adopting the perspective of a financial analysts, please provide a short report to your clients based upon ratio analysis . Please state for both companies, using only the data above, whether you would provide your clients with a buy or sell advice for each of the companies when looking at these businesses from the perspective of investors. Please justify your recommendations to your clients based upon your chosen ratios. (12 marks - Suggested word count 350-450 words)

b) It is often said that financial ratios offer more questions than answers. To demonstrate this point, please provide three examples based upon your ratio analysis of the above data where you would like more information beyond the financial statements before you would make your final decision about whether to advise your clients to invest. For each of your three examples, justify why your ratio analysis points towards the need for further investigation. (8 marks - Suggested word count 250-300 words) See Next Page

c) Building upon your answer to the previous question without repeating, discuss for each of your three examples how and why you might use non-financial information contained within the wider annual statement (e.g. strategic report, management commentary). In your answer, please be clear on specific aspects of the wider annual report you would seek to review for each of your three examples to provide the insights you seek. (10 marks - Suggested word count 300-350 words) Total marks for Question 3 (30 marks)

Section C – Testing your understanding of financial reporting from a theoretical perspective.

Answer ONE question from this section

(e.g. Question 4 or Question 5)

Question 4

Why is there often a notable difference between the book value of a company, as measured by its financial statements, and the market value of company, as measured by the stock market? Does this mean that one of the fundamental information qualities of financial reporting, namely faithful representation is not achieved? Provide the rationale for why accounting standard setters put such a strong emphasis on verifiability for items to be included in the financial statements. Critically discuss whether such a reliance on verifiability enhances or retracts from the informational value of financial statements, particularly when they are used by decision-makers who are capital providers to a business (e.g shareholders, lenders and suppliers). Please ensure in your answer to use examples of real companies to demonstrate your key points within your critical discussion . (30 marks - Suggested word count 900- 1100 words)

Marking Criteria and Weightings for Q4 and Q5

|

Criteria |

Weighting |

Requirement |

|

Understanding |

30% |

How well you show understanding of key accounting concepts and ideas. |

|

Critical Reflection |

30% |

How well you are able to critically discuss and debate the important nuances within the essay question. |

|

Use of Examples |

20% |

Your ability to demonstrate understanding with real of hypothetical examples. |

|

Structure & Scope |

10% |

How well your essay stays close the essay question and presents organised answers to the question. |

|

Presentation & Grammar |

10% |

How well your essay is written, including presentation, spelling and grammar. |

Total marks for Question 4 (30 marks)

Question 5

We are currently living through uncertain times, and this presents challenges for businesses when producing their financial statements. Provide the rationale behind why accounting standard setters require the use of the prudence concept in situations of uncertainty. Critically discuss whether such a reliance on prudence enhances or retracts from the informational value of financial statement, particularly when they are used by decision-makers who capital providers to a business (e.g shareholders, lenders and suppliers). In your answer, ensure to offer specific examples applied to real or hypothetical businesses to demonstrate how the prudence concept is applied to assure that assets or revenues are not overstated, likewise, that liabilities and expenses are not understated. (30 marks - Suggested word count 900- 1100 word)

Marking Criteria and Weightings for Q4 and Q5

|

Criteria |

Weighting |

Requirement |

|

Understanding |

30% |

How well you show understanding of key accounting concepts and ideas. |

|

Critical Reflection |

30% |

How well you are able to critically discuss and debate the important nuances within the essay question. |

|

Use of Examples |

20% |

Your ability to demonstrate understanding with real of hypothetical examples. |

|

Structure & Scope |

10% |

How well your essay stays close the essay question and presents organised answers to the question. |

|

Presentation & Grammar |

10% |

How well your essay is written, including presentation, spelling and grammar. |

Total marks for Question 5 (30 marks)

2023-01-14