Econometrics Eco311 SP21 Midterm 2

Econometrics Eco311 SP21 Midterm 2

Instructions:

1. You have from 10:10 to 11:10 to take the test. Please upload your answers typed, as a separate Word Doc or PDF.

2. Answer all the questions to your best ability---I will give partial credit. There are 100 total points. Ask me questions if anything is unclear.

3. If a question asks you to justify or explain your result, do so. Otherwise you will not get full credit.

4. Be “precise and concise” in your explanations. Do not write a lot just to write a lot.

5. Have fun and good luck!

6. Do not forgot to write your name at the top of your page.

7. This exam is open note and open internet. But collaboration with fellow students is prohibited. Do not share this exam with any other student or post it online.

1) (25 points)

Read this abstract from a regression paper by Robert M. Gonzalez evaluating the effects of cell phone coverage on electoral corruption

This paper examines the impact of cell phone access on election fraud. I combine cell phone coverage maps with the location of polling centers during the 2009 Afghan presidential election to pinpoint which centers were exposed to coverage…Polling centers just inside coverage report a drop in the share of fraudulent votes of 4 percentage points….

a) (7.5 points) Write down a RD regression equation that would allow you to estimate the effects of cell coverage on fraud. Carefully interpret the parameters of your equation.

b) (7.5 points) What conditions need to be satisfied for the approach that you specified in the previous sub question to identify a valid, causal effect? Be specific to this example.

c) (10 points) For each condition in the previous sub question, come up with a potential violation (relevant to this example) that would violate the condition and cause bias. Explain.

2) (25 points)

We are in the middle of a retail stock trading boom – many everyday Americans are putting money into non-retirement stock purchases, often through apps like Robinhood. Suppose that you want to study the effects of the recent stimulus checks on retail investment. You want to know whether adults who received the stimulus checks were more likely to invest in the stock market.

You collect stock purchase data for two groups of adults – those eligible for stimulus checks and those not eligible. You have data on their stock purchase history (or lack of history) both before and after the checks were paid out. For simplicity, you can assume the checks all arrived at the same time for recipients.

a) (5 points) How would you estimate the causal effects of receiving a stimulus check on stock purchases using a difference-in-difference strategy? Write down a regression equation, explain your notation, and identify the coefficient that estimates the difference-in-difference effect.

b) (5 points) Suppose that you want to test whether the difference-in-difference effect is statistically significantly different from zero. What is the null sampling distribution in this case? What features of the data affect how wide or narrow the null sampling distribution will be?

c) (10 points) What assumptions must you make to interpret the estimate from part (a) as a causal effect? Be specific and make sure to relate your answer to this example.

d) (5 points) If you found that there were parallel trends in stock spending before the stimulus checks arrived across groups that did and did not receive a check, does that imply that the difference-in-difference approach will estimate a valid causal effect? Explain.

3) (25 points)

A big debate in the United States today is whether we should raise the corporate tax rate. For context, former President Trump signed the Tax Cut and Jobs Act in 2017, which lowered the corporate tax rate to 21 percent starting in 2018. President Biden is proposing raising the tax rate to fund some of his priorities this year.

A key parameter for this debate is the relationship between the corporate tax rate and firm investment. If tax rates are too high, the argument goes, firms will escape overseas and not help the US economy.

You decide to collect data on firm investment (measured as part of GDP) and the national corporate tax rate for a representative sample of 50 countries.

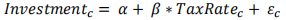

a) (5 points) Suppose that you ran the following regression using data from 2019 for your country sample

Why is β unlikely to identify a causal effect? Come up with one example of an omitted variable and carefully describe how that omitted variable would bias your estimate of β.

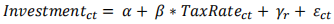

b) (5 points) Suppose instead that you collected data from 1990-2019 for all the countries in your sample and ran the following regression

Where

is a set of region fixed effects (e.g., “Europe”, “Africa”, “North America”).

Explain what comparisons in the data would be used to calculate β

c) (5 points) What types of omitted variables does the regression in part (b) control for? Be specific and give at least one example

d) (10 points) If countries that passed corporate tax cuts also passed anti-union laws at the same time, does the model in part (b) identify a causal effect? How do you know? Carefully justify all parts of your answer for full credit.

4)

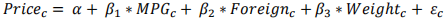

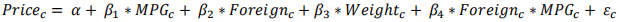

I collect data on 74 cars and run the following regression

Where Price is the price of the car in dollars, MPG is the miles per gallon that the car obtains (fuel efficiency), Foreign is a dummy variable = 1 if it is a non-US car and 0 otherwise, and weight is the weight of the car (in pounds).

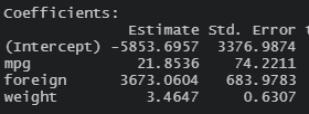

My regression gives the following results in R:

a) (5 points) Which of the three regression coefficients are statistically different from zero at a 95% level? How do you know?

b) (5 points) Using the back-of-the-envelope formula discussed in class, calculate the 95% confidence interval on the foreign coefficient. Interpret your findings in words.

c) (5 points) Suppose instead you calculated the 98% confidence interval around the foreign coefficient. Would it be larger or smaller? Carefully explain the intuition.

d) (10 points)

Suppose I estimate the following model:

Intuitively explain when the coefficient β4 would be zero

EC

Why is bootstrapping useful? Explain in one sentence.

THANK YOU!

2021-05-12