ASB 3316 – Applied Economics Assignment

ASB 3316 – Applied Economics Assignment

Did Firms Raise Finance Differently after the Paris Agreement?

Climate change poses major risks to the global economy. It affects, for example, the availability of resources, influencing the price of energy and the value of companies. The Intergovernmental Panel on Climate Change (IPCC) has concluded that the level of emissions observed since the mid-twentieth century will probably lead to global warming reaching 1.5°C above pre-industrial levels between 2030 and 2052 (IPCC, 2018). This would cause long-lasting changes, increasing the likelihood of a severe, pervasive and irreversible impact on people and ecosystems. Rising temperatures and changes in weather conditions would hit most sectors – most directly agriculture, fisheries, energy, tourism and construction – with immediate consequences for national economies (EEA, 2012). The number of natural disasters worldwide and the value of (insured and uninsured) associated accompanying economic losses have risen sharply over the last four decades (Charts 1 and 2).

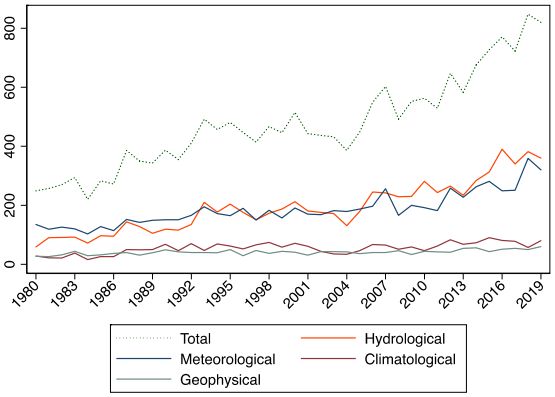

Chart 1

Number of major natural catastrophes worldwide over the period 1980-2019

(number of events; year)

Source: Munich RE (https://www.munichre.com/en/risks/natural-disasters-losses-are-trending-upwards.html).

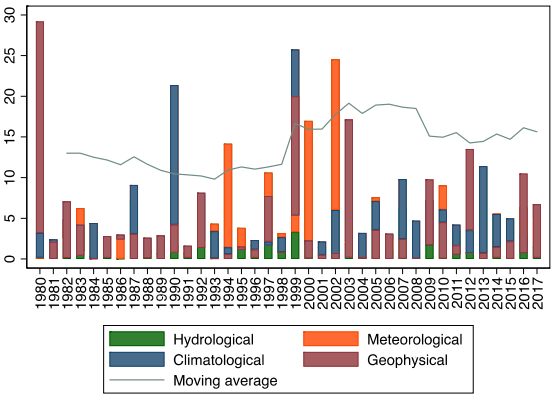

Chart 2

Economic losses from extreme climate-related events in Europe over the period 1980-2017

(EUR billions, 2017 values)

Note: The moving average is calculated over a ten-year period. The stacked bars are divided into different segments indicating the economic losses by type of event.

Source: European Environment Agency (https://www.eea.europa.eu/data-and-maps/indicators/direct-losses-from-weather-disasters-3/assessment-2).

Policymakers have, of late, started to recognise that climate change represents a major and pressing threat (Carney, 2015; ESRB, 2016). The Paris Agreement (COP21), signed in December 2015, represents a milestone: countries representing 97% of global greenhouse emissions agreed to respond to global warming by keeping global warming below 2°C. Furthermore, COP21 invites nations to publicly communicate their mid and long-term strategies for reducing gas emissions through Intended Nationally Determined Contributions (INDCs). COP21 represents the first comprehensive climate deal that explicitly recognises the need to “make finance flows compatible with a pathway toward low greenhouse gas emissions and climate-resilient development”. This means pushing for a reorientation of capital allocation (Article 2.1(c)). It also increases peer pressure with regard to meeting global warming targets, as signatories are committed to rapidly reducing CO2 emissions to achieve net zero emissions in the second half of the twenty-first century.

The aim of this research is to investigate whether, after the Paris Agreement, more polluting firms changed their way they finance their operations. It is plausible that, for instance, firms operating in more polluting sectors (oil & gas, electricity, chemicals etc.) move from market-based financing to bank based financing or vice versa. This is what, as an economist, you must try to understand and explain.

Tasks:

1) Download relevant firm-specific characteristics from Amadeus, upload the data on Stata and clean it in a way that Stata can properly read it. (25 points).

2) Write introduction, literature review, methodology, results and conclusion explaining clearly what you have done. This means explaining the research question, mentioning relevant papers, explaining the methodology used, and the policy implications of your finding. (25 points).

3) Chose the appropriate econometrics methodology to answer the research question. (25 points).

4) Layout, writing style, graphs, tables and references must be top notch. (25 points).

All Stata work must be copied and pasted in the form of a complete DO file in an appendix at the end of the document. Failure to include Stata appendix corresponding to your work will carry an automatic penalty of 25% of the available marks. Excel file should also be included in the Turnitin submission. There is no words limit. Work should be fully referenced in Harvard style.

Strict final portfolio deadline 7th May 2021. Late submission will be capped at 40% if submitted within a week from the due date. Submissions after this, or failure to submit, will result in a mark of zero for the module.

2021-05-08