ECON6072 Economic Analysis of Aging Societies

FACULTY OF BUSINESS AND ECONOMICS

ECON6072 Economic Analysis of Aging Societies

Module 5 2020-2021

Tutorial Exercise 3 (29 April): Please be well prepared to answer the following questions.

Assignment 3: Hand in Q. 2 by 6 p.m., 30 April (Friday), through the Moodle system. To help the course organization, please convert your file to pdf and use the following format for the file name: 6072_HW3_surname_firstname.pdf (e.g., 6072_HW3_Li_Lily.pdf).

Please give logical, concise and precise answers and show your steps clearly. Marks will be deducted for inadequacy as well as redundancy or irrelevancy. You should work independently and hand in your own answers.

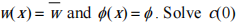

1. In the deterministic life-cycle model, suppose that the consumer chooses the consumption path (up to maximum age T) and retirement age ( R; 0 ≤ R ≤ T ) to maximize

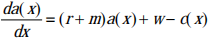

subject to the equation of motion

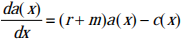

if one is working, or

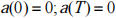

if one has retired. The boundary conditions are

Note that the notations are similar to those in the lecture notes.

(a) What is the lifetime budget constraint for this consumer? (You can just state the budget constraint and do not need to derive it.) Give an interpretation of the terms in the lifetime budget constraint.

(b) Conditional on a particular retirement age, obtain the expression characterizing the optimal consumption path.

(c) From now on, assume  , with the use of the lifetime budget constraint. (Hint: Compare your answer with equation (6) of Kalemli-Ozcan and Weil (2010). Note that the symbols in their paper and this question are different.)

, with the use of the lifetime budget constraint. (Hint: Compare your answer with equation (6) of Kalemli-Ozcan and Weil (2010). Note that the symbols in their paper and this question are different.)

(d) Based on the conditional consumption choices derived above, obtain the first-order condition characterizing the optimal retirement age. (Hint: Compare your answer with equation (7) of Kalemli-Ozcan and Weil (2010).) Give an economic interpretation of your result.

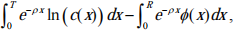

2. In a life-cycle model with lifetime uncertainty given by

where m ( m > 0 ) is the constant mortality rate, suppose that the consumer chooses the consumption path and retirement age to maximize

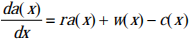

subject to the equation of motion

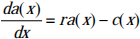

if one is working, or

if one has retired. Note that the notations are the same as in the lecture notes. It is assumed that the initial financial wealth is zero ( a(0) 0 = ), wage rate and the disutility of labor are age-invariant. Note that the maximum age in this model could be infinitely large. (Read Section 3.2 of Kalemli-Ozcan and Weil (2010) and pay attention to the relevant parts.)

(a) What is the lifetime budget constraint of the individual? (You may just state the equation and do not need to derive it.) Give an interpretation of the relevant terms.

(b) For this problem, we obtain the individual’s optimal consumption and retirement choices in two steps. The first step proceeds as follows. Conditional on a particular retirement age, define the current-value Hamiltonian, and then obtain necessary first-order conditions.

(c) Obtain the optimal consumption path from the first-order conditions in part (b). (For the remaining analysis, define the optimal consumption at age x , conditional on retirement age R , as c(x, R) .)

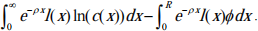

(d) From now on, assume σ = 1 . When σ =1, the consumer’s objective function becomes

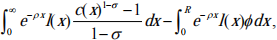

Obtain c(0, R), the initial consumption level. (Hint: You may apply useful results from earlier parts.)

(e) The second step proceeds as follows. Based on the conditional consumption choices in the first step, obtain the first-order condition characterizing the optimal retirement age. (Hint: Compare your answer with equation (12) of Kalemli-Ozcan and Weil (2010).)

3. In this question, we examine the various assumptions used in the model used in topic 6.

(a) When you decide the duration/highest level of your own education, what factors would you consider?

(b) In the lecture notes, what constitutes the benefit of more schooling? If you analyze similar issues, what relevant benefits of more schooling would you want to include? Why?

(c) In the lecture notes, what constitutes the cost of more schooling? If you analyze similar issues, what relevant costs of more schooling would you want to include? Why?

4. Consider a two-period model with lifetime uncertainty. The individual lives the first period with certainty, but there is only a probability p (where 0 < p < 1) that the individual will survive to the second period. In the first period, the individual spends fraction q of time (where 0 ≤ q ≤ 1) on schooling, and then supplies labor inelastically (i.e., no labor vs. leisure choice) for the remaining time of the first period. If he can survive to the second period, he also supplies labor inelastically. When he works in the first period, his labor income is equal to the product of working time (1− q ) and wage rate w(q) , which is a function of the schooling duration. If he survives in the second period, his labor income is equal to w(q) . The annuity market is assumed to be perfect.

(a) Denote the consumption level in the first period as c1 , the consumption level in the second period as c2 , the saving level in the first period as s1 , the wage rate as w( q) , and the interest rate from the first to second period as r . Based on the above information, obtain the lifetime budget constraint of this individual.

(b) Suppose the individual chooses q , c1 and c2 to maximize the objective function

subject to the lifetime budget constraint in part (a). What are the first-order conditions?

(c) What is the condition linking the optimal choices c1 and c2 ?

(d) From now on, assume that r = 0 and w(q)=q0.6. Derive the optimal choice of q (the fraction of time on the first period that is spent on schooling).

(e) Based on the above results, what is the effect of mortality decline (i.e., an increase in p ) on the fraction of first-period time that is spent on schooling? Explain briefly the underlying reason.

2021-04-29